Insurance is a thriving business and witnesses a huge annual turnover that hovers around billions of dollars every year. For every correct and legitimate claim, insurance companies offer compensation as per the applicable terms and circumstances. With rising frauds and deceptions on the part of insurers, insurance companies hire claim adjusters to verify, investigate and pass the claims of the insured parties. It is an important business position and hirings are done after following a strict interview process. Thus, read a lot of questions to master your interview session. A collection of some of the best interview questions is mentioned hereunder:

Table of Contents

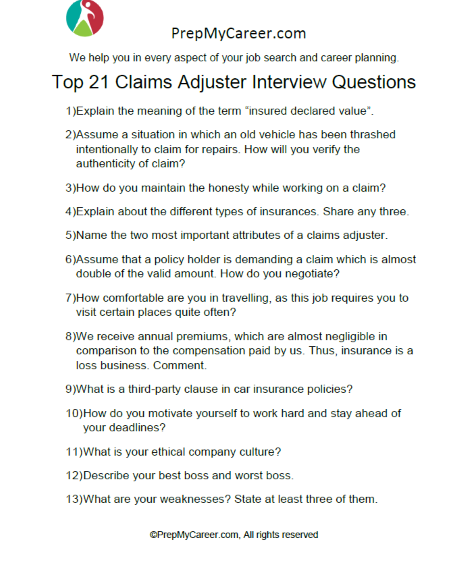

21 Best Interview Questions To Study

1. Explain The Meaning Of The Term “Insured Declared Value”.

This question tests your knowledge of the practical concepts associated with insurance.

Sample Answer

Sir, an insured declared value represents the amount at which the annual premium is calculated. It represents the purchase price of the vehicle minus depreciation. As the vehicle gets used, normal wear and tear reduce its value, which is reflected in the amount of depreciation charged.

2. Assume A Situation In Which An Old Vehicle Has Been Thrashed Intentionally To Claim For Repairs. How Will You Verify The Authenticity Of Claim?

This question tests your practical working knowledge and understanding of the procedure adopted by you to verify the claim.

Sample Answer

Sir, before extending any claim to the insured party it is necessary to verify it. I do it through this process:

- Firstly, I receive the claim documents from the customer’s end, which are scrutinized by me so as to obtain a good knowledge of the matter

- Secondly, I verify the credentials and investigate the matter by calling a special motor mechanic so as to obtain first-hand knowledge of the nature of the damage.

- Thirdly, In the instant case, a motor mechanic tells that this claim is not natural, rather fabricated. I prepare a report for the same and forward it to my manager with negative comments.

3. How Do You Maintain The Honesty While Working On A Claim?

Duplicity and deception have not been recorded from only the customer’s end but also from the employees of the company. They enter into connivance with customers and prepare inflated claims. Through this question, an interviewer wants to know how do you remain committed to your employer and display honesty.

Sample Answer

Sir, I completely understand the relevance of this interview question. It has been observed in a few cases wherein employees team up with policyholders and prepare inflated or faulty claims that lead to a higher award of compensation. This leads to a direct business loss and is detrimental to the interests of the company. In my case, be assured I will never engage myself in any such malpractice. I am here to contribute and not to lead my employer into a loss.

4. Explain About The Different Types of Insurances. Share Any Three.

This question tests your knowledge and understanding of the various types of insurances.

Sample Answer

Sure, sir, These are:

| Type of Insurance | Explanation |

| Life Insurance | To protect the future of the surviving members of a family, life insurance pays an agreed sum of money upon the natural demise of the policyholder to his or her family members. |

| Fire Insurance | It is taken by business organizations and compensates an enterprise for sustaining business losses due to fire. |

| General Insurance | This is an umbrella term and covers almost all insurances except life insurance. Vehicle insurance is a major part of it, and it compensates the owner of a vehicle or the third party for the damages sustained by them and/or by their vehicle. |

5. Name The Two Most Important Attributes Of A Claims Adjuster.

This question tests how much you understand and know about your own profession.

Sample Answer

Sir, In my opinion, Sharp-acumen and Honesty are the two most important virtues of a claims adjuster. This is because, to conduct verification of claims you need to do an investigation, which is possible only when you have a quick-thinking ability and a sharp acumen. Next, you must not fall into the trap of false claims and deceptions by conniving with the policyholders. Hence, you must remain honest and true to your employer, which is possible when you have the trait of honesty.

6. Assume That A Policy Holder Is Demanding A Claim Which Is Almost Double Of The Valid Amount. How Do You Negotiate?

This question tests your understanding of the “negotiation” and its relevance in claim adjustment.

Sample Answer

Sir, it is common for the policyholders to submit claims that are inflated and consist of almost all the items that have the possibility of being claimed. This enhances the claim bill and inflates it to more than two-three times the valid or eligible amount. I being a claim adjuster, verify all the claims on the basis of the documentary evidence and personal visits. After arriving at a figure, I generate a detailed report for the policyholder that contains the reasoning behind every rejection. This paves a founding platform for negotiation, which can be done with in-person meets or telephonic conversations.

7. How Comfortable Are You In Travelling, As This Job Requires You To Visit Certain Places Quite Often?

Being a claims adjuster you will be required to make several visits to verify the truthfulness of a claim. This is a common expectation and you must answer this question positively.

Sample Answer

Sir, being a hardworking and committed employee I am very much comfortable traveling to different places such as repair centers, mechanic’s places, transport offices, etc. Further, I have the knack for completing all my daily assignments along with traveling. This helps me to complete all my tasks in a time-bound manner.

8. We Receive Annual Premiums, Which Are Almost Negligible In Comparison To The Compensation Paid By Us. Thus, Insurance Is A Loss Business. Comment.

This question tests how much in-depth knowledge you possess in relation to the insurance business.

Sample Answer

Sir, I am afraid that how come large insurance giants are running for centuries. It is true that premiums are higher than the amount of claims, but one must always focus on the frequency. The annual premiums are received by a company from almost all its clients, but claims are paid to no more than 10% of the total policyholders. This creates a huge gap and premiums received exceed the outgo in terms of claims. Thus, a profitable situation is created and insurance companies tend to gain.

9. What Is A Third-Party Clause In Car Insurance Policies?

This question tests your knowledge and understanding of the various clauses present in the insurance policies.

Sample Answer

Sir, a third-party clause is a binding clause upon the company and the policyholder. This is present in policy agreements that cover vehicle insurances. As per this agreement, the insurance company is under an obligation to compensate for the damages sustained by a third party in cases of accidents. This covers both vehicle and human damages.

10. How Do You Motivate Yourself To Work Hard and Stay Ahead Of Your Deadlines?

We all are motivated by a few factors that prompt us to work hard and deliver stellar performance at our workplace. These factors are personal in nature and are motivated by our financial conditions, living situations, and other circumstances. Be specific while answering this question, and try giving an original answer.

11. What Is Your Ethical Company Culture?

It is common for companies nowadays to divide their workforce into different teams, on the basis of their education levels, skills, and type of tasks to be performed for enhanced productivity and related benefits. Thus, an interviewer is always interested in knowing the various qualities and attributes that you want your team members to have. You can share a few common corporate-friendly qualities such as, honest. intelligent, encouraging, supportive, skillful, etc.

12. Describe Your Best Boss and Worst Boss.

We all work at different business organizations and meet several bosses or seniors. Some of these enter into our good books while some simply fail to make the cut. An interviewer asks this question so as to know the basis or the reason behind such categorization. It is expected that you share a clear answer, which also comprises a real-life workplace situation.

13. What Are Your Weaknesses? State At Least Three Of Them.

This is a common interview question and is asked in almost all the interview sessions held across the world. The best way to answer this question is by reading the job description comprehensively and understanding its requirements. Post this, you are expected to share those weaknesses that do not conflict with the requirements of the job description.

14. There Will Always Be Instances When You Will Fail To Deliver A Perfect Performance. How Do You Manage Your Workplace Failures?

Failure is common and everybody is largely unknown of the final outcome. Yet, we work hard and perform to the best of our abilities to taste success. But not every time do we succeed and have to bear the brunt of failure. This disturbs our workplace efficiency and restricts us from performing. Ultimately, such employees fall short of their targets. Thus, an interviewer is always interested in knowing the various techniques and strategies that you have adapted to manage your failures.

15. As A Claims Adjuster, You Will Be Required To Work Upon Multiple Tasks Simultaneously. How Do You Prioritize Between The Different Tasks?

Through this question, an interviewer wants to know about your prioritization technique using which you are able to arrange your tasks for the day in a meaningful order. Usually, these tasks are ordered on the basis of time consumption or their difficulty levels. However, you are free to share any other technique as well. But, make sure you are able to explain it completely.

16. Claims Are Tough To Verify and Will Keep You On Your Toes. How Do You Manage Your Workplace Stress?

Stress management is a common expectation of business organizations and you will be required to manage it through effective techniques and strategies. Meditation, Positive pep talk, Counselling sessions, Deep breathing, etc. are some common ways to manage work-related stress.

17. How Do You Prefer To Work – Individually or In A Team?

This is a trending interview question and you are required to choose between the two options. Whatever option you choose make sure that you are giving reasonable logic and rationales.

18. When Can You Begin With Us?

This is a non-technical interview question, which requires you to share the date on or after which you can start working with the company. This question in no way guarantees your selection and you must not interpret it that way.

19. We Know That You Have Applied At Various Business Organizations Alongwith Sending Us Job Application. But, Why You Chose Us?

This question checks your level of seriousness and commitment towards the business organization. The official website of the company is the best way to prepare an answer to this question. Note all the historical achievements, business facts, and achievements of the company. Add your personal interests to your answer and prepare a good draft.

20. What Are Your Salary Expectations?

It is common for the interviewer to ask about your salary expectations during an interview session. Be spot on, and share a salary quote that is based on the average salary offered in your industry. For this, you must conduct deep research of the industry to which you belong and note all the salary details of similar professionals.

21. Do You Have Any Questions For Us?

Every interview session held across the world ends and concludes with this interview question. Through this question, an interviewer wants to know what are the various doubts and apprehensions that you have in regards to the business organization. It is recommended that you never skip this question as by doing it you will either be deemed as an unprepared candidate or simply “not interested”. Hence, always ask a few relevant counter questions from your interviewer. Read out the model questions mentioned below, for a better understanding:

Model Questions

- Can you share your experience in the business organization this far?

- What are the various incentives and allowances that are offered by the company to its employees?

- Is it the policy of the company to protect its employees from workplace harassment and bullying?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (for Claims Adjuster interviews):