Be it the collapse of Franklin National Bank in the year 1974 or be it the declared bankruptcy of Lehmann Brothers in the year 2008, the banking and finance industry has always thrived on the verge of extinction. With the world economy marred by the frequent economic recessions, non-performing accounts only add to the worries of institutions operating in the finance space.

Thus, there is a greater need to assess, evaluate and determine the risk associated with each credit profile, so that instances of borrower defaults can be minimized. A credit analyst is hired by lending companies to identify the creditworthiness of the customers of a financial institution. Read out the interview questions mentioned below and ace your interview session.

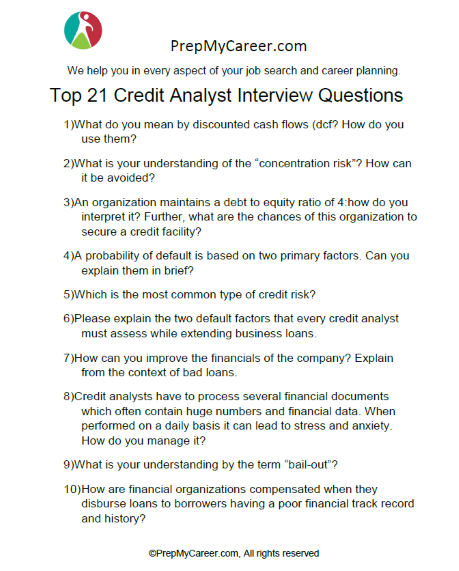

21 Best Interview Questions To Study

1. What Do You Mean By Discounted Cash Flows (DCF)? How Do You Use Them?

This question tests your core financial knowledge, which is necessary to possess in this job profile.

Sample Answer

Sir, cash flows represent the cash inflows that a business organization is expected to receive over a period of time from its regular business or any particular investment project. In order to evaluate the credit risk, it is common for credit analysts to discount these cash flows and determine a Present Value of Cash Inflows. Further, all the future expenses of the company are also discounted and a Present Value of cash Outflows is calculated. Both these values are subtracted from each other, and if:

- The NPV is positive, banks extend loans, as it indicates robustness and a situation of profitability

- The NPV is negative, banks don’t give loans, as there are chances of business losses

2. What Is Your Understanding Of The “Concentration Risk”? How Can It Be Avoided?

This question tests your knowledge and understanding of the various types of credit risks prevailing in the banking system.

Sample Answer

Sir, a situation of concentration risk arises when a lending organization extends the maturity of loans to a single business enterprise or borrower. This creates a high exposure of the lender towards a single borrower group, which forms a majority of the loan book. The fall or demise of this group can create a severe liquidation crisis among the lending company and can impact its ability to continue as a going concern. This is known as concentration risk, which can be avoided with risk-based diversification of the lending profile.

3. An Organization Maintains A Debt To Equity Ratio Of 4:1. How Do You Interpret It? Further, What Are The Chances Of This Organization To Secure A Credit Facility?

This is a practical question, which tests your financial knowledge as well as requires you to react to the situation.

Sample Answer

Sir, the Debt to Equity ratio represents the finance structure of a company. It establishes a relationship between the:

- Own funds invested by the promoters of the company and

- Borrowed funds invested in the business

An ideal debt to equity ratio is always 2:1, which means that optimally an organization must not increase its debt exposure beyond two times the equity investments made. In the instant case, for every $1 of the equity investment, there is an existence of debt worth $4. This represents poor financial management and challenges the ability of the company to service its interest as well as repayment obligations periodically. In all possible cases, such a company will not be able to obtain business loans.

4. A Probability Of Default Is Based On Two Primary Factors. Can You Explain Them In Brief?

This question tests your core finance knowledge that is relevant to your job profile as a credit analyst.

Sample Answer

Sure, sir, These are:

| Name of the factor | Explanation |

| Credit Score | A Credit score is determined by taking into consideration the credit history and behavior of the lender. The higher the credit score, the higher are the chances of the borrower to obtain credit. |

| Debt To Income Ratio | A Debt to Income Ratio is a financial metric, which determines the ability of the borrower to regularly service interest obligations as well as principal repayment. An income-heavy organization accompanied by lower debt is always a serious contender for obtaining business loans at cheaper rates. |

5. Which Is The Most Common Type Of Credit Risk?

This question tests your core working knowledge, which will be useful while discharging your duties in an office.

Sample Answer

Sir, a credit default risk is the most common type of risk which results in recognition of non-performing assets. Usually, if the borrower is not able to repay the principal amount or associated interest within 90 days of it becoming due then such a loan is categorized as bad debt, and efforts are made to recover the due amount to the extent possible.

6. Please Explain The Two Default Factors That Every Credit Analyst Must Assess While Extending Business Loans.

This question tests your knowledge and understanding of the default risks, which are contemplated by credit analysts before preparing their reports.

Sample Answer

Sure, sir, These are:

- Loss Given Default (L.G.D): It refers to the assessment of amount of loss that a lender would suffer after extending loans. For example, suppose a bank gives loans to two persons sharing similar credit scores to the tune of $10,000 and $500,000 respectively. Despite having similar credit scores, the bank would suffer more loss when the person to whom the larger amount was disbursed, defaults.

- Exposure at Default (E. A. D): It refers to an evaluation of the risk appetite of the bank and is calculated by multiplying the total loan granted by the bank pertaining to a specific category with the adjusted risk based percentage. It determines the total amount of loss that a bank could suffer at any given point of time.

7. How Can You Improve The Financials Of The Company? Explain From The Context Of Bad Loans.

This is a practical interview question and presents you with a real work-life situation.

Sample Answer

Sir, as per the general rule, the better the financial position of a banking company the higher are the chances of growth and profitability. Loan defaults (both principal and interest payments) put immense pressure on the profitability of a business organization and hampers their urge to grow and expand. The restructuring of loans granted to troubled business organizations is one of the best ways to reduce the probability of default risk and also prevents the organization from substantial capital losses.

8. Credit Analysts Have To Process Several Financial Documents Which Often Contain Huge Numbers and Financial Data. When Performed On A Daily Basis It Can Lead To Stress and Anxiety. How Do You Manage It?

This is a behavioral interview question and requires you to share ways using which you are able to manage your stress levels.

Sample Answer

Sir, to be very honest, routine tasks and processes have the ability to crush any corporate employee under its monotony. When adequate measures are not adopted, and this depressed attitude is continued for a long period of time, it might lead to severe stress and anxiety. I always adopt two of my tried and tested techniques to manage my work-related stress, these are:

- Deep breathing exercises: I perform sets of 10 deep inhales and exhales using my alternate nostrils.

- Positive pep talk: I always motivate myself using confidence-boosting mantras

9. What Is Your Understanding By The Term “Bail-Out”?

This question tests your awareness of the common financial terminology, especially used in the finance space.

Sample Answer

Sir, “bail-out” is referred to as stress funds, which are granted to business organizations having an abysmal financial position. These funds are provided by the government authorities, marquee individual investors, or any private equity firm.

10. How Are Financial Organizations Compensated When They Disburse Loans To Borrowers Having A Poor Financial Track Record and History?

This question tests your knowledge of the basic financial concepts and understanding of the industry.

Sample Answer

Sir, in the world of corporate finance, there is a popular rule, the higher the risk, the higher are the chances of earning rewards. Ideally, a finance company must not extend loans or any sort of financial assistance to an organization, which has a poor track record and history. Yet, every company gives loans to such organizations, as a part of their diversification strategy. In order to compensate themselves, they charge a high rate of interest, which is higher than the interest rate charged from a borrower having an optimal credit profile.

11. A Manufacturing Agency Has Allocated Its Fixed Overheads Using Labour Hours As The Cost Driver. Please Explain This Statement In The Light Of Managerial Accounting.

Most business houses, especially the ones having an active interest in manufacturing goods, prepare their books of accounts using the concepts of cost accounting. These books act pivotal in assessing the real operational health of an organization. Thus, as a credit analyst, you must be aware of the various principles of managerial accounting.

Sample Answer

Sir, in managerial accounting, the overheads incurred by the company are absorbed upon the finished products on the basis of an appropriate cost driver. It helps in accurately identifying the actual cost of production incurred in manufacturing a particular product. For example, if the overhead allocation rate is $40 per labor hour and it takes 3 labor hours to manufacture a product then its cost would be $120 ($40 per hour x 3 hours).

12. Your Performance Will Be Regularly Checked From Time To Time On Established Benchmarks. How Will You Ensure That You Don’t Attract Negative Feedback or Criticism?

It is common for business organizations to develop employee performance evaluation systems and assess their performance by comparing them with established standards. As an ideal response, just share the strategies using which you can deliver an excellent performance.

Sample Answer

Sir, the key to working excellently at the workplace lies in the understanding of the job profile and applying all your gathered or acquired knowledge while executing the processes and functions. In my case, I always:

- Gather as much information as possible before initiating an assessment or evaluation

- Develop strategies and processes using which, I am able to properly analyze the borrower profile in question

- Regularly monitor or review the developed strategies and identify all the shortcomings

13. What Are The Popular Signs That Must Not Be Ignored While Evaluating Credit Risks?

This question tests your practical working knowledge.

Sample Answer

Sure, sir, These are:

- The borrower has got its loan applications rejected quite a few times

- The borrower has defaulted in the past either in the repayment of principal amount or service of periodical interest

- The borrower is not able to obtain credit cards

14. What Should A Credit Analyst Must Always Look For In A Financial Statement?

This question tests your practical working knowledge.

Sample Answer

Sir, in my humble opinion, a credit analyst must have a keen eye upon:

- The general reserve balance maintained by the body corporates and

- The savings accumulated by an individual borrower, in the form of fixed deposits, mutual funds, and the other savings instruments.

15. Your Resume Shows A Total Work Experience Of Four Years. Can You Decsribe Your Best Boss and Worst Boss?

Through this question, an interviewer wants to know about the exact reasons or the basis using which you are able to categorize your good boss and a bad boss. Be specific and never get carried away while narrating the bad part.

16. What Are Your Strengths and Weaknesses?

This is a common interview question and is asked in almost all the interview sessions held across the world. To prepare an ideal response, just conduct deep scrutiny of the job description issued to you and underline all the key requirements besides determining the primary attributes. Post this, share strengths that align with these requirements and weaknesses that do not conflict with them.

17. Credit Analysts Have To Perform Tasks and Duties That Are Repititive In Nature. How Do You Keep Yourself Motivated?

There is always an existence of an internal force, which keeps us motivated and pushes us to work hard at our workplace. These are our motivational factors that are highly influenced by our financial conditions and living conditions. An interviewer is always interested in knowing these factors for personality evaluation.

18. When Can You Start Working With Us?

This is a non-technical interview question and requires you to share a genuine date on or after which you can start working for the company. Be clear in your answer, and share a true date, instead of saying after 15 days or 20 days.

19. What Are Your Salary Expectations?

To prepare an ideal response for this question always conduct deep scrutiny of the industry to which you belong and calculate an average salary. In the instant case, determine the salaries offered to the credit analysts, who have work experience similar to you. Calculate the average and share a salary figure, which is based on it.

20. We Are An Established Finance House and Will Assign Several Tasks To You With All Of Them Having A Fixed Deadline. How Do You Prioritize Your Tasks?

Through this question, an interviewer wants to know about your prioritization technique using which you are able to arrange your tasks on the basis of any pre-determined criteria. You can share any of your adopted methods, and explain them using any real-life work experience.

21. Do You Have Any Questions For Us?

Be it an interview session of a bank cashier or a credit analyst, every big day concludes and ends with this interview question. Thus, this is your last opportunity to impress your interviewer and must be capitalized to the maximum extent. This can be done by asking some relevant counter questions from your interviewer in regards to the business organization, its working culture, the ethics followed, the rules in place, etc. Broaden your imagination and prepare an ideal response by asking the model questions mentioned below:

Model Questions

- What are the various anti-harassment rules that are implemented by the company at the workplace?

- How are the promotional aspects of the company?

- You have been working in this company for quite a long period of time. Can you share your work experience?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (For Credit Analyst interview):

References

- https://www.richtmann.org/journal/index.php/ajis/article/view/12685

- https://implementationscience.biomedcentral.com/articles/10.1186/s13012-021-01111-5

Sandeep Bhandari is the founder of PrepMyCareer.com website.

I am a full-time professional blogger, a digital marketer, and a trainer. I love anything related to the Web, and I try to learn new technologies every day.

All the team management, content creation, and monetization tasks are handled by me. Together with the team at PrepMyCareer, the aim is to provide useful and engaging content to our readers.