Recording, and classifying financial transactions not only helps a business organization to understand their financial standing but also helps in making long-term business decisions. Accounting is an essential need for companies and makes them compliant with the existing laws and regulations. Within the several processes, lies the position of accounts receivable, whose primary responsibility is to record all the transactions that are related to debtors and other collectibles of the company.

Table of Contents

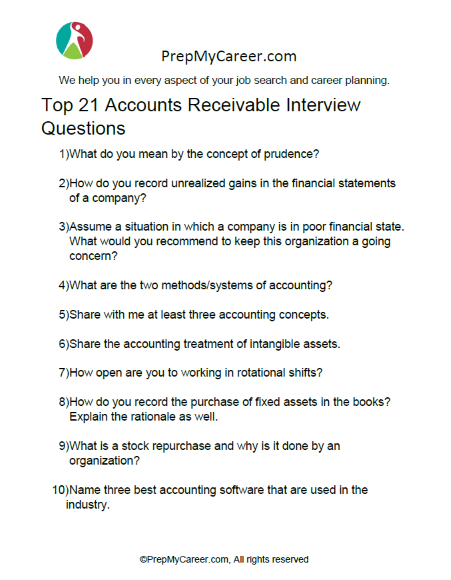

21 Best Interview Questions To Study

1. What Do You Mean By The Concept Of Prudence?

This question tests your knowledge and understanding of the core accounting concepts and principles.

Sample Answer

Sir, prudence is an important accounting concept, and its use is mandated in almost all countries. As per this concept, a business organization is required to record all the expected business losses that are in contemplation of the company. For example, a company expects around 5% of its debtors to turn bad. These losses must be recognized now, even though these are not materialized yet. These are recorded by making a provision, which is a charge against profits.

2. How Do You Record Unrealized Gains In The Financial Statements Of A Company?

This question tests your knowledge and understanding of recording different financial transactions of the company.

Sample Answer

Sir, unrealized gains are those profits or cash inflows that have not yet materialized and are still notional in nature. However, as per the provisions contained in the U. S. GAAP, it is necessary to even record these unrealized gains in the balance sheet of the company under the sub-heading of “Other Comprehensive Incomes” and under the major heading “Equity”. The unrealized gains will increase the equity balance and the unrealized losses will reduce the equity balance.

3. Assume A Situation In Which A Company Is In Poor Financial State. What Would You Recommend To Keep This Organization A Going Concern?

This question tests your grip on the various practical aspects of accounts.

Sample Answer

Sir, in such a scenario I will recommend a restructuring scheme to the company, under which it can align its debt obligations as per the expected cash flows of the company after having a conversation and meeting with its creditors.

4. What Are The Two Methods/Systems Of Accounting?

This question tests your knowledge and understanding of basic accounting.

Sample Answer

Sir, there are two systems of accounting, these are:

- Cash system: In this system or method, the financial transactions are recorded only when actual cash is received or goes out of the company. This is a simple method and is followed by those companies that have a lower business turnover.

- Accrual system: This is a complex accounting method, in which transactions are recorded on an accrual basis or on an unrealized basis. If there is a reasonable possibility of an income, which will be received and an expense, which will be incurred, than such transactions are recorded irrespective of actual materialization.

5. Share With Me At Least Three Accounting Concepts.

This question tests your knowledge and understanding of the core accounting concepts and principles.

Sample Answer

Sure, sir, These are:

| Name of the Accounting Concept | Explanation |

| Matching concept | Using the matching concept, a business organization is required to record all the expenses and incomes that pertain to a particular period, in that period only. For example, Unpaid salaries of the accounting period 2021-2022 will be recorded in this year itself. |

| Cost concept | As per this concept, business organizations are required to record the fixed assets at their acquisition cost, which includes the purchase price of the asset and all the expenses incurred until the asset is ready to use. |

| Business entity concept | This concept states that a business organization has its own legal identity which is distinct and separate from its owner. |

6. Share The Accounting Treatment Of Intangible Assets.

This question tests your knowledge and understanding of the various types of accounting treatments.

Sample Answer

Sir, intangible assets are recorded in the balance sheet at their acquisition cost. It is to be noted that most of the intangible assets are self-developed by a company and as per the provisions these are not required to be entered into the books of accounts. Only purchased intangible assets, such as goodwill, trademark, copyright, etc. are recorded in the books. Further, these intangible assets must be properly amortized.

7. How Open Are You To Working In Rotational Shifts?

This is a common interview question, which checks your comfort while working in rotational shifts.

Sample Answer

Sir, I completely understand the relevance of this interview question. I am open to working in the rotational shifts and will be ready to work in every time slot that the company assigns to me. Be assured that I will never refuse to work in an allotted time slot, no matter even if it is a night slot.

8. How Do You Record The Purchase of Fixed Assets In The Books? Explain The Rationale As Well.

This question tests your knowledge and understanding of the various types of accounting treatments.

Sample Answer

Sir, the fixed assets are recorded in the books of accounts at their historical cost. For the first time in the beginning, the fixed assets are recorded in the books at their acquisition cost plus expenses incurred until the asset is put to use. Next, these assets are depreciated using a relevant method (straight-line method, written down value method, etc.). The basic rationale behind these is the cost concept, going concern concept, (recording at historical cost) and the matching concept (depreciation).

9. What Is A Stock Repurchase and Why Is It Done By An Organization?

This question tests your knowledge and understanding of the core accounting concepts.

Sample Answer

Sir, equity financing is a common method using which companies raise funds. It is true that the issue of equity shares helps an organization to mobilize funds but it also dilutes the stake of the promoters and reduces their decision-making power. Thus, at the later stages, companies prefer to re-purchase the shares so that they are able to consolidate their stake and restore their decision-making ability.

10. Name Three Best Accounting Software That Are Used In The Industry.

Technology governs it all and has taken over almost all the business processes. Gone are the days when transactions were recorded using hand ledgers. In this digital age, there are accounting software that records financial entries.

Sample Answer

Sure, sir, These are:

- Quickbooks

- Zoho Accounts

- Xero

11. The Impact “Failure” Has Upon An Employee Is Quite Deep and Profound. How Do You Manage Your Failures?

It is a common belief that failures leave a devastating impact upon human minds. In the corporate world, failure is quite common and is largely inevitable. The failure when sustained by employees makes them feel depressed and renders them incapable of performing to the best of their abilities. Thus, an interviewer is always interested in knowing the various techniques using which you can manage your workplace failures.

12. What Do You Mean By The Term “Quality”? Explain From The Context Of Working In The Corporate Sector.

This is a word-based interview question. We all are different and have ideologies and thinking that make us interpret this term differently. An interviewer through this question wants to know about your own version of interpretation of this term.

13. How Do You Prefer To Work – In A Team or Alone?

This is a tricky interview question, which requires you to choose between the two options or modes of working. However, you will never be safe, no matter what option you choose. This is because, if you choose “individually” you will be rendered as a person who is incapable of working in harmony by maintaining a good rapport with our members. On the flip side, if you prefer to work in a “team” you will be assumed as a person who is incapable of working under minimum supervision and guidance. But, you will be compulsorily needed to choose an option, which you can justify with ample logic.

14. Accounting Is A Busy Profession and We Will Assign You Several Tasks To Be Performed In A Single Business Day. How Do You Prioritize?

This question requires you to state your prioritization technique using which you are able to arrange or order your tasks in a meaningful order. Mostly, employees prefer to arrange their tasks on the basis of:

- Time consumption: The tasks that consume the most time are ranked first

- Difficulty level: The tasks that are tough and requires a greater application of mind are ranked first

However, you are free to share your own strategy, but never forget to explain it with ample logic.

15. Stress Is A Common Mess Among Employees. How Do You Manage Your Stress Levels?

Stress management is a common expectation of the business organization, as while being under stress, there are high chances that you will not be able to perform to the best of your abilities and ultimately not deliver sub-standard performance. Thus, an interviewer is always interested in knowing the various techniques and strategies using which you manage your stress. Meditation, Deep breathing, and Positive-pep talk are considered as some of the best ways to regulate stress.

16. Accounts Receivable Is A Repititive Position and You Will Be Required To Perform Similar Tasks. What Motivates You To Work?

We all are motivated by a few factors that prompt us to work hard and achieve our goals and objectives in a time-bound manner. These factors are personal in nature and are largely influenced by our personal circumstances, financial situation, and other living conditions. Hence, be original and avoid generic answers.

17. What Are Your Strengths and Weaknesses?

This is a common interview question and is asked in almost all the interview sessions held across the world. Through this question, an interviewer wants to know what are your various strengths and weaknesses so that he or she can assess whether or not you will be a perfect match for the culture of the company. The best way to prepare for this question is by reading the job description issued to you by the employer and sharing those strengths that align with the primary requirements of the job and weaknesses that do not conflict with it.

18. When Can You Start and Begin Working With Us?

Through this question an interviewer wants to know about your availability. As an ideal response, just share a date on or after which you can start working with the company. Further, this question in no way guarantees your selection and hence you must not interpret it that way.

19. What Are Your Salary Expectations?

It is common for the interviewers to ask abut your salary expectations during the interview session itself. It is recommended that you always share a salary figure that is based on some extensive research of the industry to which you belong. Calculate a mean or average salary and base your answer on it. Further, you might be more skillful than people in your industry, and wish to enhance your salary bracket than the mean salary offered. In such a case, never deviate more than 15% of the mean salary.

20. Why You Chose To Work With Us?

Through this question an interviewer wants to check your level of seriousness and commitment towards the business organization you sought to work with. The best way to prepare for this interview question is by browsing the official website of the company and noting all the relevant details, such as achievements of the company, historical facts, etc. Add your personal interests to your answer and compile the data to form a structured answer.

21. Do You Have Any Questions For Us?

It is a common habit of the interviewers to end an interview session with this question. If you ever face this question, be assured that your big day has ended and now there is no more questioning from you. Thus, it gives you one last opportunity to impress your interviewer. Ask a few relevant counter-questions from your interviewer that are based on your doubts and apprehensions in regards to the company. Read the following model questions for a better understanding:

Model Questions

- What are the various incentives and allowances that are offered by the company to its employees?

- Please share a list containing all the work timings that are followed by the company in its different shifts.

- Is it the policy of the company to offer paid leaves to its employees, especially in medical emergencies?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (for Accounts Receivable interviews):