Interviews are certainly stressful, not just for the one who has to give the interview but also for the interviewer who is going to take the interview. From choosing the right candidate to expressing in the best possible method, the arena is quite challenging and competitive.

To meet these demands, here are some of the most asked internal audit interview questions along with the answers to help you for the interview.

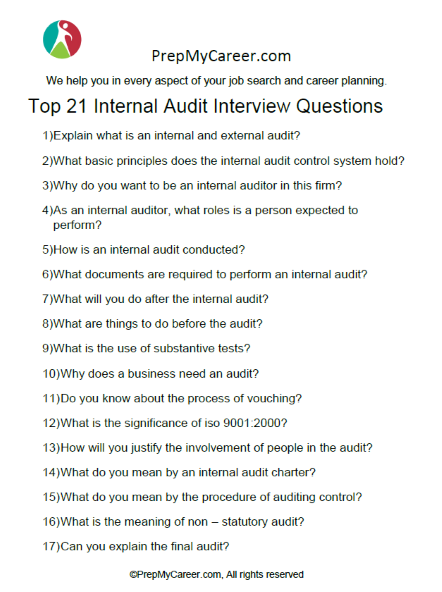

Internal Audit Interview Questions to Prepare Well

1. Explain what is an internal and external audit?

Sample Answer

Internal audits are carried out to assist management. The management’s flaws are meant to be exposed. Management is in charge of appointing internal auditors. Internal audit is an important aspect in control of internal management.

External audit, whereas, is an integral component of external control. The external audit will not be able to advise improvements to the internal control system. The external auditor can only carry out his duties following the conditions of his appointment and other laws that are applicable in that scenario. The scope is really broad.

2. What basic principles does the internal audit control system hold?

Sample Answer

The basic principles that the internal audit control system holds are following:

A. Accounting and financial operations should be kept separate. Responsibility for work performance must be communicated explicitly so that there is no opportunity for ambiguity or misinterpretation afterward.

B. Too much trust should not be placed in a single person. Almost the majority of the scams were perpetrated by trustworthy authorities or workers. This is powerful anti-collision protection that is widely regarded as a good organizational canon.

C. Work should be mechanized, with mechanical instruments such as cash registers and computation machines being introduced.

D. The job should be organized in such a way that any work which is completed by an employee is re-checked by another independent employee. Such perpetual monitoring ensures operational control, moral watch, and errors and frauds can never go unnoticed.

3. Why do you want to be an internal auditor in this firm?

Sample Answer

I can learn about businesses, advance my career, and become a better decision-maker by working for an internal audit firm. It has provided me with a thorough grasp of how businesses operate. It has helped me strengthen my communication skills, leadership talents, and analytic abilities. I appreciate the everyday activities at this business because they help me to possess a better skill set.

4. As an internal auditor, what roles is a person expected to perform?

Sample Answer

An internal auditor conducts a thorough examination of an organization’s business processes. Then assess the present risk management methods for their adequacy. An internal auditor works to keep the company’s assets safe from theft. After that, he assesses the organization’s compliance with applicable laws and legislation. Finally, he/she makes recommendations on how to strengthen internal control and governance systems.

5. How is an internal audit conducted?

Sample Answer

First, I make sure my objectives are correct, identify dangers, and re-examine them. Then I plan my auditing tactics and actions. I double-check the information and complete the task. Finally, I create a deliverable report that will influence action and then monitor the entire process.

6. What documents are required to perform an internal audit?

Sample Answer

The treasurer provides all financial documents for the internal audit. The bank statement, canceled checks, deposit slip, checkbook register, expense vouchers, and the annual treasurer’s report are all examples of these.

7. What will you do after the internal audit?

Sample Answer

Following the internal audit, I convened a meeting with all of the auditors who took part in the audit. During the meeting, I discuss the non-conformances and the parts that have been removed. I provide the audit report on schedule and then encourage the auditee to remedy any errors. I participate and demonstrate to individuals responsible for finishing the assignment the proper way to set up appropriate deadlines. Finally, I get the auditee’s answer and monitor its progress.

8. What are things to do before the audit?

Sample Answer

I increase the audit team’s strength to encourage auditees to band together. I determine which areas of the organization require auditing as well as the frequency of the audits. Then create and disseminate a yearly audit schedule. I assess the audit’s goal and determine if it adheres to government requirements, quality, and standards. In addition, I’m planning a meeting with the auditors to go through the strategy, scope, and goals. After that, I read the audited paperwork.

9. What is the use of substantive tests?

Sample Answer

A substantive test is an audit technique that looks at the financial statements and supporting documents to see if there are any mistakes. This test is used to support the claim that an entity’s financial records are complete, accurate, and legitimate.

10. Why does a business need an audit?

Sample Answer

The Audit Committee or the Company’s shareholders have asked for it. The primary goal of the contemporary audit is to help the management in accomplishing its goals and objectives by using pre-defined procedures and assessing risks.

11.Do you know about the process of vouching?

Sample Answer

Yes, Vouching is the process of making a comparison of the authenticity of a voucher that is held by management with the accompanying documentation.

12. What is the significance of ISO 9001:2000?

Sample Answer

ISO 9001:2000 is a standard that outlines the standards for a quality management system. A company must demonstrate its capacity to regularly deliver a product that meets consumer and regulatory criteria.

13. How will you justify the involvement of people in the audit?

Sample Answer

Take advantage of audits to train others. As assistance, request a volunteer (who is not an auditor) to take you through the whole process of auditing. Others will have a better knowledge of what audits are and why they are important as a result of this. To the final meeting, invite all auditees. As someone who has been audited, I know how beneficial it is to hear audit results personally, both favorable and bad. People’s involvement provides the impression that they are all important contributors to the company’s aim of compliance.

14. What do you mean by an internal audit charter?

Sample Answer

The Internal Audit function’s goal, independence, impartiality, scope, duties, authority, accountability, and standards are all outlined in this charter. A charter is a decentralization of authority from one person or one organization to another person or organization. The objective of an internal audit charter is to obligate several departments that need to be audited to furnish the required details to the auditor. Most managers would not understand the advantage of being audited if they didn’t have this charter or comparable powers, and they would likely refuse to furnish anything the auditor required.

15. What do you mean by the procedure of auditing control?

Sample Answer

Audit control procedures comprise certain policies and procedures that are set by management along with the control environment to satisfy the entity’s unique objectives.

16. What is the meaning of non – statutory audit?

Sample Answer

The non-statutory audit is not obligatory by law, and the ambit of the audit will be pre-defined by the contract held between the auditor and the clients.

17. Can you explain the final audit?

Sample Answer

When all accounts have been closed and final accounts have been prepared, the final audit begins.

18. Name some types of audits.

Sample Answer

Statutory, non-statutory, final, social, internal, and external audits are some of the types of audits.

19. Why does an organization need an internal audit?

Sample Answer

An audit assists in keeping track of where money is going and ensures that it is going where it is meant to go and not into the pockets of the wrong people. An audit can also reveal if a firm is losing money or profiting.

20. What challenges do you foresee in the role of an internal auditor?

Sample Answer

An official written report delivered weeks or months after a problem is discovered is a standard means of conveying audit results to management. The internal audit report discusses the findings. It leaves no place for the information that the board and management requirements. To avoid all of these, more talking rather than writing should be done. As a result, information will be more easily delivered and decisions will be done more quickly.

21. What are the advantages and disadvantages of internal auditing?

Sample Answer

The following are some of the benefits of internal auditing:

- It is cost-effective.

- Internal auditing does not need the use of chartered accounts.

- Before compiling financial statements, any errors will be corrected. Because mistakes have been eliminated, there will be no humiliation in society.

- Accounting employees will be under constant pressure to keep records up to date at all times in the organization.

The following are some disadvantages:

- The majority of the time, the shareholder does not approve of internal audits.

- Internal audit may contain inaccuracies since he is not an auditor.

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (For Internal Audit interview):

References

- https://www.emerald.com/insight/content/doi/10.1108/02686900610634775/full/html

- https://www.emerald.com/insight/content/doi/10.1108/02686901111151332/full/html

Sandeep Bhandari is the founder of PrepMyCareer.com website.

I am a full-time professional blogger, a digital marketer, and a trainer. I love anything related to the Web, and I try to learn new technologies every day.

All the team management, content creation, and monetization tasks are handled by me. Together with the team at PrepMyCareer, the aim is to provide useful and engaging content to our readers.