Financial managers are responsible for the financial structure of a company and play an important role in its expansion and development. Finance Managers maintain the company’s financial activities and based on their analysis and observation they provide guidance and advice to the higher management.

Every company relies on its Finance Manager to ensure its success. The Finance Manager controls the company’s capital and is the driving force behind every company’s success. A Finance Manager’s responsibilities include analyzing accounts, forecasting economic performance, finding ways to increase profits, and reducing losses. They also keep a sharp eye on the markets for business development chances such as amalgamation, investment, and possession.

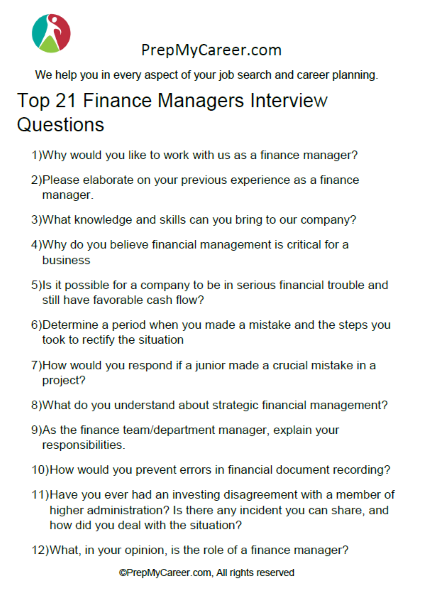

The Top 21 Interview Questions To Prepare Well

1. Why Would You Like to Work with us as a Finance Manager?

Sample Answer

After obtaining my finance degree, I became very motivated in pursuing a job as a Finance Manager. I want to upgrade my abilities and expertise. Working for your reputable company will allow me to advance in my career while also providing me with a unique experience.

2. Please elaborate on your previous experience as a Finance Manager.

Sample Answer

I worked on a variety of initiatives as a Finance Manager for Xyz Company. I was in charge of creating project financial goals and strategies, maintaining records, and guiding my team to make sound judgments. I was always able to fulfill timelines, which allowed the company to reduce costs and increase profits.

3. What knowledge and skills can you bring to our company?

Sample Answer

I’ve worked hard to improve my abilities and expertise throughout my employment. My top priorities are time management, open interaction, and a well-planned timetable.

These assist me in carrying out my obligations and responsibilities more efficiently and effectively. With my absolute effort, I feel I can assist this organization in maximizing revenues.

4. Why do you believe financial management is critical for a business

Sample Answer

Financial management is critical for any organization, regardless of size or scope, because it aids in the effective operation of a corporation. A corporation can meet organizational and legal objectives by having a sufficient supply of funds, controlling shareholders’ returns, establishing economic plans, filing tax reports, complying with legal obligations, and maintaining financial management.

5. Is it possible for a company to be in serious financial trouble and still have favorable cash flow?

Sample Answer

It is conceivable for a corporation to appear to have favorable cash flows while being in serious financial distress. Although there are various ways to do so, two of the most important are to demonstrate improved working capital (by selling goods but deferring payables) and to include a lack of sales in the pipeline. These can go a long way toward helping a corporation save its public image amid a crisis.

6. Determine a period when you made a mistake and the steps you took to rectify the situation

Sample answer

I spend a huge amount of money on one activity without first obtaining written consent from the sponsor, resulting in the spending being prohibited by the sponsor. That money has to be returned to the sponsor by my current employment.

After that, I created a budget tracking application that records all requisition documents and informs the procurement department of the funds available for each action.

7. How would you respond if a junior made a crucial mistake in a project?

Sample Answer

I make sure to leave sufficient room in my projects for unexpected obstacles. If a junior makes a serious error, I will do everything I can to explain to him what was his mistake and how he may prevent it in the future, and involve him in a short practice session before allowing him to engage in the same project again.

8. What do you understand about Strategic Financial Management?

Sample Answer

Strategic financial management is the process of regulating a company’s finances by following a strong plan. It assists the company in achieving its targets and objectives while boosting profitability, returns on investment, and investor value.

9. As the Finance Team/Department Manager, explain your responsibilities.

Sample Answer

As the head of a finance team, I will ensure that I perform my obligations on time to ensure that my team remains on schedule. To maintain a sense of unity, I will ensure clear communication in the team.

I will also try to incorporate a professional culture by maintaining a pleasant and flexible approach.

10. How Would You Prevent Errors in Financial Document Recording?

Sample Answer

I advocate adopting dependable software and cross-checking to eradicate human mistakes. In addition, I will ensure that the relevant employee is not overburdened.

11. Have you ever had an investing disagreement with a member of higher administration? Is there any incident you can share, and how did you deal with the situation?

Sample Answer

In my previous employment, our company‘s CFO sought to identify methods to increase profitability by investing in start-up firms. It was the end of September and we were expecting money from the clients to cover our existing responsibilities.

To assist them to understand why I was making this decision, I put together a report that showed how current customer remittances would hardly cover current obligations. This prompted the CFO to contemplate postponing our investment strategy until after the new year began.

12. What, in your opinion, is the role of a Finance Manager?

Sample Answer

A Finance Manager’s job is to lead and execute good financial management processes, as well as to give management timely and accurate financial data, extensive analysis, and business insight to help them make better decisions. They are also in charge of financial management.

13. Can you explain what a deferred tax liability is and why it exists?

Sample Answer

In simple words, a deferred tax liability arises when the relevant sum of tax is paid to the IRS at a later period. In reality, it is the exact reverse of the deferred tax asset.

In general, a case for deferred tax liability emerges whenever the IRS reporting and the GAAP reporting differ. Such inconsequential variations could lead to lesser tax payments to the IRS in the future.

14. What exactly do you mean when you say “working capital”?

Sample Answer

Working capital is the cash available, whether it’s from profit savings, a line of credit, or another source of cash. Working capital is used to finance your day-to-day activities, pay rent and employees, and meet other operational costs.

Working capital is simply the money you have on hand to meet your short-term expenditures.

15. What is your time management strategy as a Finance Manager?

Sample Answer

I think that sticking to a schedule will ensure that tasks are completed on time. I schedule must-do chores first thing in the morning and leave the remaining for later.

16. Differentiate between real and nominal money. Describe treasury bills as well.

Sample Answer

The only type of money that has its fundamental purchasing power is real money. Whereas, Nominal money has to do with enumeration or numbering in a technical sense. Therefore, the bill reflects the nominal money.

Treasury notes can be regarded as money market tools used to fund the government of India’s short-term monetary needs. Treasury bills are discounted securities that are sold at a lower price than their full price.

17. What exactly do you mean when you say “adjustment entries”?

Sample Answer

Adjustment entries are entries that are made at the end of every financial period. The main goal of adjustment entries, as the name implies, is to adjust the nominal and variable accounts to create a steady account on the accounting records.

A balance sheet is a necessary component for determining a company’s impartiality. To put it another way, adjustment entries serve as a draft before the actual entries are approved.

18. When you worked as a Finance Manager, what tools and equipment did you previously use?

Sample Answer

In my academic years, I learned how to use a variety of financial management tools, involving software, and programs such as Oracle, SQL, Database Management system, etc. I’ve been utilizing Oracle for several years as a financial manager, and I’m competent at SQL.

19. Determine the difference between Free Cash Flow to Firm (FCFF) and Free Cash Flow to Equity (FCFE) (FCFE).

Sample Answer

To evaluate highly leveraged free cash flow, FCFF excludes interest expense and net loan repayments, while FCFE incorporates both of these components.

20. Can you explain the differences between hedging and preference capital?

Sample answer

Hedging can be characterized as a tool for reducing risk. In other words, hedging may be akin to the primary goal of insurance. Nevertheless, the key distinction among the two is that hedging is focused on mitigating risks rather than increasing profits.

Preference capital, on the other hand, can be described as the capital that has priority over the equity at the period of dividend payment and the firm’s closing down.

21. What tools do you use to carry out your responsibilities as a Finance Manager?

Sample Answer

Finance Managers must be familiar with and comprehend accounting and reporting processes to identify and repair system mistakes and improve financial reporting to management. They also require knowledge to assist them in planning, organizing, and carrying out their everyday tasks.

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (For Finance Manager interview):

References

- https://www.researchgate.net/profile/Ntiedo-Ekpo/publication/319078811_Finance_Manager_and_the_Finance_Function_in_Business_Sustainability/links/598ee7ee458515b87b395b0a/Finance-Manager-and-the-Finance-Function-in-Business-Sustainability.pdf

- https://www.sciencedirect.com/science/article/pii/S1045235413000166

Sandeep Bhandari is the founder of PrepMyCareer.com website.

I am a full-time professional blogger, a digital marketer, and a trainer. I love anything related to the Web, and I try to learn new technologies every day.

All the team management, content creation, and monetization tasks are handled by me. Together with the team at PrepMyCareer, the aim is to provide useful and engaging content to our readers.