The circulation of money is what keeps the economy running. No business can progress and carry on its operations without capital, which is mobilized by banks and financial institutions from domestic and foreign depositors. In order to promote financial inclusion and the scope of lending activities, these financial institutions spread out and establish several branches in different areas.

Each of these branches is managed and controlled by a Branch manager. Hence, if you are having upcoming interview sessions for this post, never forget to read out the interview questions mentioned below.

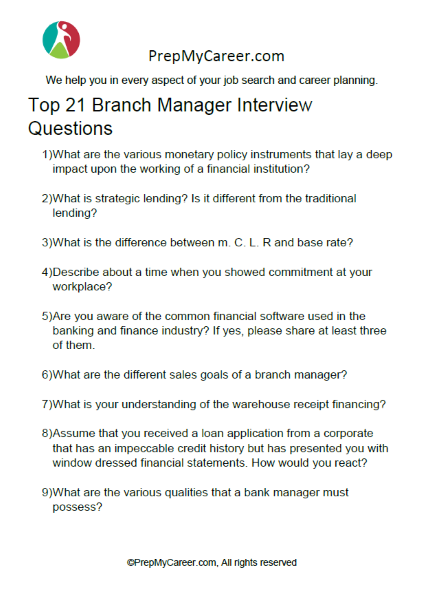

21 Best Interview Questions To Study

1. What Are The Various Monetary Policy Instruments That Lay A Deep Impact Upon The Working Of A Financial Institution?

This question checks your understanding of the various central bank policies and their impact on the banking and finance industry.

Sample Answer

Sir, the banking and finance industry always is regulated by the central bank of that country, through several guidelines, policies, and rules. Out of these are the monetary policy instruments, which stabilize the prices, reduce rigidity and promote efficiency. Some common instruments are:

- Cash Reserve Ratio (C. R. R): The minimum percentage of the total bank deposits, which they are required to keep as cash

- Statutory Liquidity Ratio (S. L. R): The minimum percentage of the total bank deposits, which they are required to maintain in the form of gold, marketable securities, and other liquid assets

- Repo Rate: The interest rate at which commercial banks obtain funds from the central bank, for further lending

- Reverse Repo Rate: The interest rate at which the commercial banks keep their surplus funds with the central bank

- Open Market Operations: The central bank of the country sells and purchases securities in the money market

2. What Is Strategic Lending? Is It Different From The Traditional lending?

This question checks your understanding of the different types of lending.

Sample Answer

Yes, Sir, strategic lending is different from traditional lending in which loans are not granted to the general public or the business houses. It is a special type of lending in which the loans are extended to fund community projects, such as affordable housing, energy efficiency operations, municipal development, rural development, alternative sources of energy, etc.

These loans are granted for long durations, have a larger ticket size, and bear an interest rate that is lower than the interest charged in traditional loans.

3. What Is The Difference Between M. C. L. R and Base Rate?

This question tests your practical working knowledge.

Sample Answer

Sir, M. C. L. R stands for Marginal Cost of Fund Based Lending Rate. Both these terms are different from each other and can be distinguished using three primary parameters.

| Basis of Difference | M. C. L. R | Base Rate |

| Governed By | 1) Repo rate 2) Reverse repo rate 3) Deposit rate | 1) Operating expenses 2) Cost associated with maintenance of cash reserve ratio |

| Calculated on the basis of | Tenor premium | The minimum rate of return of the bank |

| Determinants | The marginal cost of funds | The average cost of funds |

4. Describe About A Time When You Showed Commitment At Your Workplace?

This is a behavior-based interview question, wherein, you are required to narrate any real professional event in which you showed maturity, commitment, and dedication towards your employer.

Sample Answer

Sir, banking is a tough business and is always dependent upon the business performance of the customers. I remember one instance, when, while working as a trainee branch manager, how I went at length to scrutinize a large loan application.

In this case, the financial statements were exhibiting the sound financial position of the applicant and showed a good collection of valuable assets.

However, when I made several personal visits to all the physical locations, I found that the company was a fraud and has presented us with fake financial statements. During these days, I used to work for more than 12 hours a day, which amply shows my perseverance as well as dedication.

5. Are You Aware Of The Common Financial Software used In the Banking and Finance Industry? If Yes, Please Share At Least Three Of Them.

This question tests how much are you aware of the different software used in the banking industry.

Sample Answer

Sure, sir, These are:

- Oracle FLEXCUBE

- CorePlus

- Finastra

6. What Are The Different Sales Goals Of A Branch Manager?

This question checks how much you understand your current business profession.

Sample Answer

Sir, the role of branch manager is quite diverse. Besides managing the staff and existing customers, s/he is also required to drive growth and sales of the branch. The different sales goals of a branch manager are:

| Name of the Sales Goals | Explanation |

| Customer Acquisition | The branch managers are assigned fixed customer targets, which need to be accomplished by growing the customer base of the financial institution. |

| Business Development | The branch managers are required to: 1) Meet the loan targets 2) Sell the insurance policies 3) Sell the various investment schemes 4) Open saving, Demat, and loan account |

| Growth of Deposit and Lending Base | The branch managers are required to expand the branch’s deposit base by attracting funds from the public and extending loans. |

| Sale of Banking Services | In addition to the regular lending, the branch managers are required to find customers for their other services, such as factoring, discounting, brokerage, trading, etc. |

7. What Is Your Understanding Of The Warehouse Receipt Financing?

This question tests your knowledge of the various services offered by the banks to their customers.

Sample Answer

Si, the primary purpose of the banks and the financial institutions is to create credit in the economy and make that credit available to the people who need it. Warehouse receipt financing is another method using which loans are extended to the farmers, industrialists, manufacturers, wholesalers, traders, etc.

In this financing, loans are granted on the basis of a warehousing receipt, which depicts the value as well as quantity of “goods” that are stocked in a warehouse.

8. Assume That You Received A Loan Application From A Corporate That Has An Impeccable Credit History But Has Presented You With Window Dressed Financial Statements. How Would You React?

This is a situation-based question in which you are required to react and extend your response to the presented situation.

Sample Answer

Sir, the safety of the principal and interest of the loan amount is an essential function of a branch manager. In the instant case, it seems that the organization has not approached the bank with clean hands, which poses a significant default risk. Hence, as a branch manager, I would not extend any loan to such an organization.

9. What Are The Various Qualities That A Bank Manager Must Possess?

This question checks how much you understand your profession.

Sample Answer

Sir, the role of a branch manager is not less than that of a generalist. Hence, in order to discharge the duties effectively, s/he must possess the following qualities:

- Financial literacy

- Eye for detail

- Leadership

- Empathy

10. What Is Your Understanding Of The N. P. A? How Could You Reduce It?

This question tests your understanding of the knowledge of the basic banking terms.

Sample Answer

Sir, N. P. A stands for Non-performing asset. If any loan or advance extended by a financial institution remains overdue for a period exceeding 90 days then it is recognized as N. P. A. The usage of settlement schemes, effective dispute resolutions, and debt restructuring can come in handy in controlling this mess.

11. There Are Various Deposit Instruments On Which Banks Are Required To Pay A Higher Interest Rate, Especially Deposit Schemes Meant For Seniors. Don’t You Think This Must Be Avoided As It Leads To Severe Financial Burden On The Company Finances?

This is an opinion-based interview question, which criticizes the high-interest rates offered to senior citizens. In an ideal response, just defend the higher rates offered using reasonable arguments.

Sample Answer

Sir, it is true that financial institutions are profit-driven, and extending higher rates to the elderly lays stress on profitability. However, it must be considered that the elderly rely on instruments of fixed income (Bank FDs) for meeting their essential requirements. Hence, to support them financially every bank must continue offering them prioritized rates.

12. What Do You Mean By Debt Factoring? What Are The Various Business Risks Associated With It?

This question tests your knowledge of the various services offered by the banks to their customers.

Sample Answer

Sir, debt factoring is a short-term source of finance for business organizations, wherein they raise funds from the banks on the basis of their accounts receivables at a discount.

It is certainly challenging for the banks, as sometimes the debtors of the company fail to meet their obligations in part or full. This leads to loss, the quantum of which is higher than the discount charged by the banks.

13. The Diversity In The Workforce Makes It Tough For The Employees To Operate Without Conflicts and Disputes. Comment On This Statement.

Sample Answer

Sir, I completely disagree with this statement. This is because all the employees inside a company have to work as per the established rules, standards, procedures, and benchmarks. This leaves little to no scope of disputes on the basis of race, religion, caste, or creed.

14. What Are The Consequences Of Extending Majority Of Business Loans To A Single Business Organization?

Sample Answer

Sir, the biggest risk of extending a majority of the loans to a single organization is the “concentration risk”. It limits the scope of portfolio diversification and poses a serious risk upon the ability of the bank to continue as a going concern, in case a default is made by this single organization.

15. As A Branch Manager You Will Be Responsbile For Performing Multilple Tasks. All Of These Tasks Have Fixed Deadlines and Need To Be Timely Submitted. How Do You Ensure A Timely Delivery?

Most developed business organizations assign several tasks to their employees that need to be executed in a timely manner. This is possible only when the employees are able to rank or arrange their tasks on a pre-determined basis, such as, on the basis of:

- The difficulty level of the tasks, where the toughest tasks are performed at the beginning of the shift

- The urgency level, where the tasks having the nearest deadlines are performed at first

- The yield level, where the tasks returning the maximum yield are performed in the beginning

- The time consumption, where the most time consuming tasks are performed at the beginning to gain psychological advantage

All the bases mentioned above come under the umbrella of the prioritization technique. Hence, just state whatever works for you and try justifying it using any practical work experience.

16. What Are Your Salary Expectations?

This question is asked in almost all the interview sessions, wherein an interviewer determines whether or not you and S/he are on the same page.

To give an optimal salary bracket, conduct thorough research of the industry and note down the different salaries offered to the branch managers, who share a work experience similar to you. Calculate an average salary and make sure that your expectations are at par with this mean.

17. The Legacy Of Our Institution Lies In The Efforts Of Our Talented Employees. Thus, We Only Hire Human Resources That Are Special and Have Something Unique In Them. What Can You Offer Us That Someone Else Cannot?

With time, interviewers have also evolved their interview questions. This question is an advanced version of the regular interview question, “What are your strengths?” as it requires you to state those elements, which separate you and give you a competitive advantage over the others.

To prepare a perfect response to this question, just read out the job description issued to you and try to understand it in its entirity. Post this, just identify the various attributes that would work best for this position/ job role and share them in response to this question.

18. Branch Managers Have To Often Deal With The Customers and Different Clients Of The Bank. When Done On A Daily Basis It Can Lead To Stress and Anxiety. How Do You Handle This Situation?

Stress is a common issue that is prevalent among corporate employees. The repetitive nature of tasks and daily routines takes a toll on the employees and leaves them gasping for air. This leads to stress and anxiety, forcing them to deliver sub-standard performance.

Hence, through this question, an interviewer wants to know, what are the various techniques and strategies that you adopt to manage your stress levels.

19. We Are In The Business For The Past Three Decades and Have Seen Several Ups and Downs. We Have Survived Every Situation Owing To Our “Quality” Processes. How Do You Interpret The Term “Quality”?

This is a word-based interview question, wherein you are required to interpret the word, “quality”. Each corporate employee is different and views something with different perspectives.

This leads to considerable variations in the interpretations of the terms, facts, and figures. Hence, it is recommended that you always share an original response for this question, and ignore all the generic answers.

20. When Can You Start Working With Us?

The job seekers are not available for working immediately due to their prior commitments and obligations. This requires the interviewer to ask this question, through which, your expected date of start is requested. Be genuine, while sharing the expected start date, and always keep a margin or buffer of at least two working days.

Further, it must be noted that this question in no way guarantees your selection. Hence, refrain from interpreting it that way.

21. Do You Have Any Questions For Us?

Be it the position of zonal director or a branch manager, every interview session comes to an end through this interview question. It concludes your big day and hence presents you with one last opportunity to impress your interviewer. Thus, to give a perfect response, always ask some relevant counter-questions, which are related to the company, its work culture, and the different benefits offered. For a better understanding, just read out the sample questions mentioned below:

Sample Questions

- Sir, How does it feel to work in this organization? Can you share some advantages and disadvantages of this company?

- What are the different shift timings that are followed by the organization?

- Can you please list all the anti-harassment policies that are implemented by the company at the workplace?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (For Branch Manager interview):

References

- https://www.sciencedirect.com/science/article/pii/S1053482220300620

- https://www.tandfonline.com/doi/abs/10.1080/19463138.2020.1780241

Sandeep Bhandari is the founder of PrepMyCareer.com website.

I am a full-time professional blogger, a digital marketer, and a trainer. I love anything related to the Web, and I try to learn new technologies every day.

All the team management, content creation, and monetization tasks are handled by me. Together with the team at PrepMyCareer, the aim is to provide useful and engaging content to our readers.