What is the one thing that you like the most? Your family, that’s fine. Oh, not family, but your country, that’s more than fine. But, what about money? Yeah, that’s the real deal now. Finance is the backbone of every person, and it will not be wrong to say that everybody works hard in order to earn money and lead a life full of pleasures and joy.

Table of Contents

We are certainly not talking about the things that money cannot buy, but what it can. Individuals as well as business organizations, strive to create wealth and for this, they need the help of a financial advisor, who can manage their money, invest it and guide them about the latest developments in the field of finance. If you are going to attend an interview session for a financial advisor, never forget to read our special collection of interview questions:

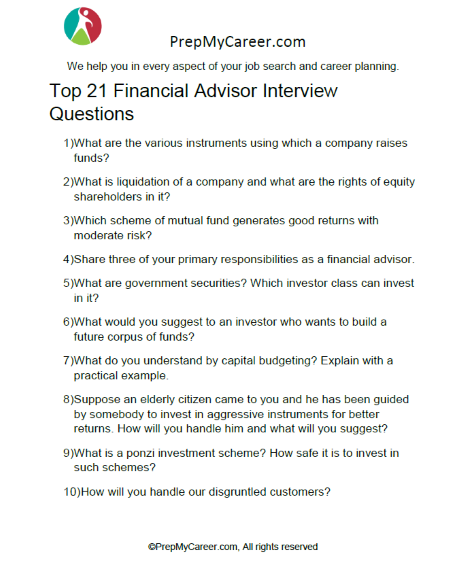

21 Best Interview Questions To Study

1. What Are The Various Instruments Using Which A Company Raises Funds?

There are various ways, using which business organizations raise funds from the public. This translates into a liability for the fundraising corporation and acts as an investment avenue for the investor. This question checks your core finance knowledge.

Sample Answer

Sir, a company raises funds using a variety of sources, such as issues of bonds, debentures, equity shares, preference shares, external commercial borrowings, banks borrowings, etc. All these sources can be categorized into two primary headings, which are, Debt and Equity. The debt instruments pay a fixed interest at regular intervals on the basis of a pre-determined coupon rate. On the other hand equity instruments, pay dividends, but that is not fixed and depends upon the discretion of the company.

2. What is Liquidation Of A Company and What Are The Rights Of Equity Shareholders In It?

This question checks your core domain knowledge and tests your understanding of the various investment risks.

Sample Answer

Sir, liquidation represents the closure of a business organization, preferably because of a drop in revenue and lack of sufficient collateral to repay its debts, which leads to bankruptcy. In the event of liquidation, the equity shareholders are the last claim holders and are eligible to get back their investment after all the other claim holders, such as preference shareholders, debenture holders, employees, government dues have been paid.

3. Which Scheme Of Mutual Fund Generates Good Returns With Moderate Risk?

This question tests your knowledge of various investment avenues available in the market.

Sample Answer

Sir, in my humble opinion, a hybrid scheme of a mutual fund, which invests in both equity and debt instruments is the best scheme to generate optimal and ideal returns, with a moderate level of risk. This is because the risky nature of equity investments is set off and balanced by the debt instruments.

4. Share Three Of Your Primary Responsibilities As A Financial Advisor.

This question checks how much you understand and know about your own profession.

Sample Answer

Sir, in any organization, the role of a financial advisor is huge in scope and one’s duties are largely dependent upon the department to which one is assigned. However, generally, a financial advisor is responsible for:

- Invest the surplus funds of the company so as to generate competitive returns

- Control, monitor, and reduce the costs of the company, by preparing budgets and other reports

- Reduce the debt burden of the company by generating enough investible surplus, which can be ploughed back into the business

5. What Are Government Securities? Which Investor Class Can Invest In It?

This question tests your knowledge of various investment avenues available in the market.

Sample Answer

Sir, government securities, or g-secs, are the debt instruments, which are floated by the government of every country to finance public expenditure. These instruments carry a sovereign guarantee with them and possess zero risk of default in either repayment of principal or periodic payment of interest. All these securities carry a fixed coupon rate with them and are issued for a very long duration, such as 30 or 40 years. These act as a pension plan for the elderlies and thus act as a perfect instrument for elderly citizens.

6. What Would You Suggest To An Investor Who Wants To Build A Future Corpus Of Funds?

This question tests your grip on your profession and checks how efficient are you in giving advice.

Sample Answer

Sir, people love to accumulate money, by investing in various instruments. A regular inflow of money at periodic rests (monthly) piles up and earns handsome returns. This leads to a corpus of funds, which can be used for future purposes. I would suggest a growth scheme of mutual funds depending upon the risk appetite of the investor. If the risk-taking ability of the investor is moderate, I would suggest a balanced plan, and in case he is aggressive, I would suggest him an all-equity plan.

7. What Do You Understand By Capital Budgeting? Explain With A Practical Example.

Bring a financial advisor, you are not limited to investing the surplus, but are also responsible for strategically analyzing the various investment proposals, and deciding their feasibility.

Sample Answer

Sir, capital budgeting is a technique that is based on the time value of money. In this technique, the future cash flows from a particular investment proposal are discounted using the targeted rate of return, and a present value is determined. If the net present value (Present value of cash inflows minus Present value of cash outflows) of the project is positive then a company can consider and invest in the proposal.

8. Suppose An Elderly Citizen Came To You and He Has Been Guided By Somebody To Invest In Aggressive Instruments For Better Returns. How Will You Handle Him and What Will You Suggest?

This question checks how honest you are with your profession.

Sample Answer

Sir, undoubtedly, the commission of the advising firm from the inflows made into the aggressive instruments is much higher, but we need to be ethical in our conduct. I will never suggest or advise any of our elderly clients to invest in aggressive instruments as these carry high default risk, and in worst circumstances, even the entire corpus can get wiped out. Instead, I would suggest such a person, that he invests in gilt mutual funds.

9. What Is A Ponzi Investment Scheme? How Safe It Is To Invest In Such Schemes?

This question checks your understanding of the various frauds and financial crimes that happen regularly in the financial market.

Sample Answer

Sir, everybody loves to receive a high return on their money. The concept of doubling of money is so popular in the investor class, that we see every now and then a new investment scheme offering stellar returns. However, this fancy ends abysmally, and most of the schemes turn out to be Ponzi.

A Ponzi scheme is a deceptive investment scheme, which promises high returns, but the collection of new money is used to repay the earlier promises. The money collected is never invested in any avenue, rather is used to repay the prior commitments. This balloon inflates in its initial years, and people do get their returns, but ultimately it ends and leads to tears, monotony, and guilt. It is not at all safe to invest in such schemes.

10. How Will You Handle Our Disgruntled Customers?

This question checks your ability and technique for handling discontent customers.

Sample Answer

Sir, every customer must be respected and honored. If I will ever face such a customer, I will first of all try to understand what are the various issues and problems that the customer is experiencing using my active listening skills. Post this, I will use my critical thinking ability and would try to find out the possible solutions and resolutions that could satisfy the customer. In most cases, he or she will agree after some thoughtful negotiations and bargaining.

11. Describe About A Time When You Gave A Wrong Financial Advice Under Pressure From Your Senior.

This is a tricky interview question, that puts you under the influence of an ethical dilemma. Never be diplomatic, and do not try avoiding this interview question.

Sample Answer

Sir, working in the corporate sector is not easy, rather challenging, and sometimes tough. It can certainly put you in some crazy situations, wherein you will be required to take some delicate decisions. I remember one such instance when a middle-aged person came for financial help, and he wanted to invest his hard-earned money into a fixed income plan bearing low risk. However, my manager had different plans, and he instructed me to guide him towards the blue-chip fund of the ABC mutual fund company. Being a committed employee, I followed my manager, however, not without telling the customer, the risks of doing so.

12. As A Financial Advisor, You Will Be Required To Deal With Lots Of Numerical Data and Mathematical Calculations, Which Can Be Hectic At Times. How Do You Manage Your Stress Levels?

Stress is a common issue that most corporate employees face while executing their duties. While being stressed or burned out, they are unable to perform their duties in a time-bound manner, and ultimately give a sub-standard performance. Thus, an interviewer is always interested in knowing the various strategies and techniques using which you are able to manage your stress levels.

13. What Are Your Strengths and Weaknesses?

This is a common interview question and is asked by every interviewer during the hiring process. The best way to answer this question is by reading the job description issued to you by the employer and understanding the major requirements. Post this, just share the strengths that match with these requirements and weaknesses that do not conflict.

14. Descibe Yourself In One Word.

This is a tricky interview question, which requires you to summarize your whole personality using a single word. Use common corporate-friendly words, such as hardworking, creative, innovative, dedicated, detail-oriented, etc. to define yourself.

15. “Quality” In Operations Is What We Follow And Preach. What Do You Make Out Of This Term?

This is a word-based interview question and requires you to interpret the term “quality”. Share an original answer and avoid all the generic ones. This is because, there could be multiple interpretations of this little word, but an interviewer is interested in only your own version.

16. What Do You Follow To Manage Your Workplace Failures?

Failure is experienced by all of us. Humans want to succeed every time but unfortunately, that’s not how things and this world works. A failed person fights a war inside his mind that spares nobody. It is said that war changes everybody, and no soul returns holy from it. Failure has the ability to lead you into depression, wherein you will be dependent upon some external help. Thus, you ought to develop some strategies that can help you manage your failures. These strategies are demanded through this question.

17. What Is Your Ethical Team Culture?

It is common for business organizations to work in a team setup, wherein employees are divided into different teams on the basis of several parameters, such as their education levels, nature of skills, and nature of tasks to be performed. Through this question, an interviewer wants to know what are the various qualities and attributes that you expect your team members to possess.

18. As A Financial Advisor, We Will Keep You Busy and You Will Be Required To Perform Several Tasks. How Do You Prioritize?

This question requires you to state your prioritization technique using which you are able to arrange and order your tasks on the basis of several pre-determined factors, such as the difficulty level of the tasks, expected time consumption, etc. Be specific, and explain your technique using real experiences.

19. What Are Your Salary Expectations?

It is common for the interviewers to ask about your salary expectations during an interview session itself. It is recommended that you always share a salary bracket that is based on some extensive research of the industry to which you belong. Calculate a mean salary and do not deviate more than 15% from it.

20. Why You Chose To Work With Us?

This question tests your commitment and seriousness towards the business organization you sought to work with. Use persuasive language to answer this question, and frame a perfect reply by compiling the historical facts related to the company, its achievements, and your personal interests.

21. Do You Have Any Questions For Us?

It is common for the interviewers to end an interview session using this interview question. Through this question, an interviewer wants to know what are the various doubts and apprehensions that you might have in regards to the business organization. It is recommended that you always attempt this question, as failure to do so would mean that either you are unprepared or not serious about this job. You can always ask a few counter-questions, based on the model questions mentioned below:

Model Questions

- What are the work timings that are adopted by the company in various shifts?

- Please share a list of all the incentives and allowances that are offered by the company to its employees.

- What are the policies of the company in regards to promotion to the next position?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (for Financial Advisor interviews):