Financial planning is extremely vital for a company as it would affect the company’s investment and finance factors. The interview questions of financial planning and analysis professionals would mainly deal with their knowledge of the finance structure of a company. The accounting and analytical knowledge of the person would get tested in the interview for FP&A.

The interview would mainly depend on the factors such as analytical, technical, and behavioral factors. The experience of the person would be asked by the interviewer for checking the candidate’s teamwork skills. Preparing for the FP&A interview is vital for avoiding any issues amidst the interview. People should work on their communication and listening skills for qualifying in the interview.

The interview question would also depend on the experience and communication skills of the candidate. Therefore, to make the interview more interesting, people should try to improve their communication skills as communication gaps can affect the answers of the candidate.

It’s always better to not say random things while answering a question as the interviewer would always look for precise answers. The person should be properly dressed and follow the correct sitting position in the interview.

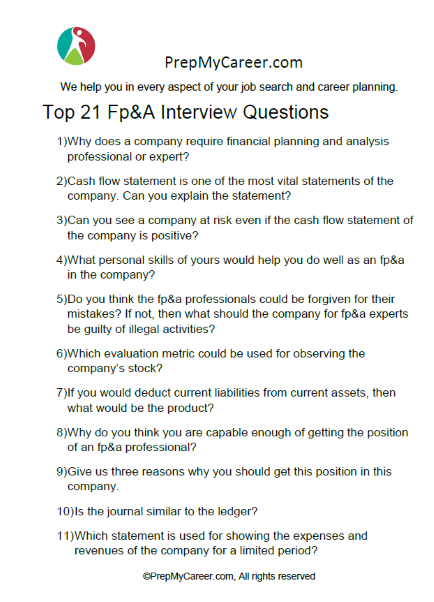

Top Financial Interview Questions To Prepare Well

1. Why does a company require financial planning and analysis professional or expert?

Sample Answer

The financial area of the company requires an expert who can control the financial issues of the company by improving its financial health. Financial activities such as modeling, budgeting, and financial planning are handled and controlled by the financial planning analysis professional.

2. Cash flow statement is one of the most vital statements of the company. Can you explain the statement?

Sample Answer

The income of the company would change depending on various factors. The balance sheet accounts changes would influence the cash equivalents of a company. All these changes happening to the balance sheet accounts or income of the company would be observed with the help of a cash flow statement. Therefore, the cash flow statement is very significant for the company.

3. Can you see a company at risk even if the cash flow statement of the company is positive?

Sample Answer

I think the most important thing to be considered for a company is to know the source of income. The company should keep a track of the source of income along with where the income is getting invested. If the company would know how money is coming and where the money is going, then it would reduce the risks at the company.

A cash flow statement is important, but checking up on the income is a better way to reduce troubles for the company.

4. What personal skills of yours would help you do well as an FP&A in the company?

Sample Answer

People with good management skills and knowledge about the finance department of the company can try becoming an FP&A. The people who have their expertise in the financial background can look at their future in the FP&A field.

5. Do you think the FP&A professionals could be forgiven for their mistakes? If not, then what should the company for FP&A experts be guilty of illegal activities?

Sample Answer

I would not support an FP&A professional doing any mistake or illegal activity in the company. People should be careful if they are involved in the department. The FP&A professionals involved in the illegal activities should get fired from the company or the company should handle them as per the legal policy.

6. Which evaluation metric could be used for observing the company’s stock?

Sample Answer

I think, there is no such particular evaluation metric that the company can use for observing or analyzing the stock. There are many metrics that the company can use for checking up on the stock. One of the most effective evaluation metrics is a price-to-earnings ratio which is used by most of the company depending on their criteria and conditions.

7. If you would deduct current liabilities from current assets, then what would be the product?

Sample Answer

Working Capital.

8. Why do you think you are capable enough of getting the position of an FP&A professional?

Sample Answer

My educational background and personal interest both brought me here at this juncture where the FP&A area is the most suitable one for me. I have had always been very interested in the financial field and mainly in the company. Therefore, it’s my dream to join as an FP&A in your company.

9. Give us three reasons why you should get this position in this company.

Sample Answer

My three reasons would be the following:

- I am a good student with proper knowledge in this field.

- I have a good experience that would help me do my best in the financial field.

- I have worked previously as an FP&A in another company and this would make it easier for me to join this company.

10. Is the journal similar to the ledger?

Sample Answer

No, both journal and ledger are different from each other in various aspects. The journals are taken as a reference for the making of the ledger.

11. Which statement is used for showing the expenses and revenues of the company for a limited period?

Profit and loss (P&L).

12. If the company wants to predict or analyze the profitability of a specific project of the companies, then what would be considered by the company?

Sample Answer

With the help of Net Present Value (NP, V) the company can get an overview or prediction about the profitability of a specific project.

13. Is income statements covered under the financial statement of the company?

Sample Answer

Yes, the company has four main financial statements and an income statement is one of them.

14. Why the capital structure is important for every company?

Sample Answer

Capital structure is very important for knowing how the company works for various financial operations. The capital structure would make the company know their growth rate in financial sectors. The capital structure is also vital for knowing the investment of funds that would help in the growth of the company.

15. What skills do you have that other candidate may not have for this position?

Sample Answer

I can’t say what skills other candidates don’t have, but I would like to say that I have all the qualities that are required for becoming a successful FP&A professional. My knowledge and experience in this field would help me avoid any risks associated with the finance department of a company.

16. Why do you think valuation techniques are important for a company?

Sample Answer

The company needs to keep a track of the valuation of stocks or businesses. Therefore, the company requires various valuation techniques.

17. Is Quantrix a BI tool (business intelligence tools)?

Sample Answer

Yes, Quantrix is an important business intelligence tool.

18. Can you use Income for determining or measuring the company’s liquidity?

Sample Answer

Finding the company’s liquidity with the help of income is possible, but if the company chooses the cash flow, then it would be the best idea.

19. Why do you think experience is a vital category for any financial job opportunity?

Sample Answer

In every field, people require good knowledge about the work field. Having past knowledge would help the person to know the field in a better manner. Theoretical knowledge would not help if you don’t have practical knowledge or expertise in a specific field. A beginner always struggles with learning the foundation or basic ways in which a company’s financial model or structure work.

The financial department of the company is quite complex and it needs good people in it. The people that belong to the financial field are better options for becoming an FP&A professional. If the people would have great knowledge, skills, and experience, then these all would help them become good FP&A professionals.

20. Explain the positive and negative sides that the employees of the companies may see.

Sample Answer

Every human comes with some positive and negative qualities. As an FP&A professional, I would be humble and polite to people that would work in a team. I would try to keep the respect of every employee that are intending to contribute to the company. People may see the bad side of mine if they are not willing to work for the welfare of the finance department of the company.

Everyone looking for their benefits without concentrating on the benefits of the company may not find me as a good FP&A professional.

21. The workload of an FP&A professional is huge. Do you think you can manage all the responsibilities or duties without any chaos? What techniques would you follow to keep the financial planning & analysis department of the company updated?

Sample Answer

I know that the FP&A professionals have to do real hard work with dedication to meeting the targets of the company. I believe that no work is easy or difficult, it’s just that they are different. Sometimes, the work is less and the other day it would be very high. People should be prepared mentally for work-life. I would not face any difficulty in completing or taking huge responsibilities.

For me, all the works in this financial planning and analysis field are covered under my interest area. I never get issues working in my interest area even if the workload is more than a requirement. I would try to complete the work assigned to me on the same day it was given. I would check with the policy of the companies to make sure the work is not getting done in the wrong manner. I would keep a track of all the work to be completed for avoiding delays in planning or budgeting.

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (For FP&A interview):

References

- https://www.financialplanningassociation.org/sites/default/files/2021-03/AUG09%20The%20Changing%20Role%20of%20the%20Financial%20Planner%20Part%201%20From%20Financial%20Analytics%20to%20Coaching%20and%20Life%20Planning.pdf

- https://academic.oup.com/sf/article-abstract/83/4/1469/2234815

Sandeep Bhandari is the founder of PrepMyCareer.com website.

I am a full-time professional blogger, a digital marketer, and a trainer. I love anything related to the Web, and I try to learn new technologies every day.

All the team management, content creation, and monetization tasks are handled by me. Together with the team at PrepMyCareer, the aim is to provide useful and engaging content to our readers.