Finance is the heart and soul of any business. It can be considered as the very basic existence of any operational business enterprise. This prompts several youths to pursue courses in finance in order to make a bright future for themselves. Wells Fargo is one such esteemed financial services organization headquartered in the United States of America and in existence for almost a century. It is a dream for many fresh as well as experienced finance professionals to be a part of such a reputed organization. However, sweet dreams command some bitter hard work and painstaking efforts. The interviews conducted by Wells Fargo are highly technical and require some excellent knowledge of finance and commerce.

Table of Contents

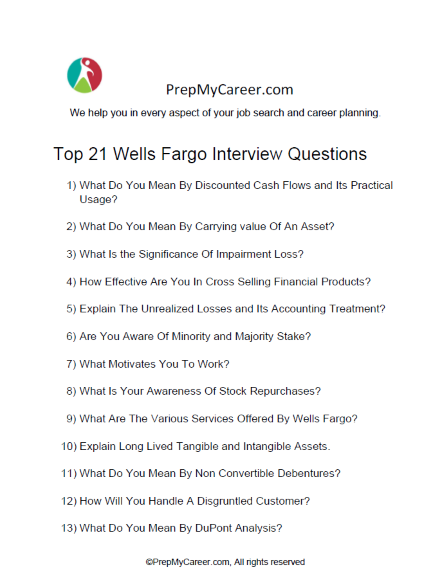

Best 21 Interview Questions To Study

1) What Do You Mean By Discounted Cash Flows and Its Practical Usage?

This question tests your knowledge of the core principles of financial management.

Sample Answer

It is common for business organizations to acquire various other business enterprises at their optimal valuation. The target company, sought to be acquired, must be having some operational cash flows generated from the usual course of business. These cash flows are discounted using an applicable rate of return and are brought to the present value. A sum total of all the present values is then compared to the cost of acquisition. If the present value is more than or equal to the cost of acquisition, a business enterprise is advised to acquire that organization.

2) What Do You Mean By Carrying value Of An Asset?

This question tests your knowledge of the core principles of financial management and accounting.

Sample Answer

Carrying value simply means the value at which an asset is depicted in the balance sheet. Initially, when an asset is purchased, it is shown at the cost of acquisition, which is the sum total of the purchase price of the asset and all the ancillary costs incurred in bringing the asset to its present state. such as legal fees, loading and unloading charges, labor costs, regulatory fees, etc. This cost is further depreciated using an appropriate depreciation method followed by the organization until its useful life.

3) What Is the Significance Of Impairment Loss?

This question tests your knowledge of the core principles of asset management and its accounting.

Sample Answer

It is common for several fixed assets such as plant and machinery, furniture, property, etc. to suffer a permanent reduction in their value due to various reasons, such as:

- Obsolescence

- Regulatory/Legal changes in relation to that particular asset

- Change in consumer behavior

- Permanent damage to the physical state of the asset, etc.

Such situations lead to a permanent loss in the value of an asset. As per US GAAP, it is mandatory for business organizations to record this fall in value as impairment loss as an expense in the income statement. An impairment loss would always decrease the profit of an enterprise as it is a direct charge to the profit and loss account.

4) How Effective Are You In Cross Selling Financial Products?

This question tests your knowledge and awareness of the practical working procedures.

Sample Answer

A financial organization like Wells Fargo, develops a lot of financial products, such as credit cards, checking accounts, global remittances, debit cards, mutual funds, etc. In order to effectively cross-sell a product, it is necessary to make a customer aware of all the benefits, returns, and incentives of a particular financial scheme, post which a customer can decide and choose. I have extensive knowledge of all the financial products and have effectively as well as impressive communication skills, which I believe would immensely help me in making sales smoothly and achieve those targets in a time-bound manner.

5) Explain The Unrealized Losses and Its Accounting Treatment?

This question tests your knowledge of the core principles of finance, costing and accounting.

Sample Answer

Unrealized losses are the imaginary/artificial losses incurred by an organization that has absolutely no impact on the actual cash position of an organization. For example, ABC Corporation purchased 200,000 shares at the rate of $15 from the open market. The current market price of the shares is $8. In such a case, the unrealized losses for the company are 200,000 shares x ($15 – $8) per share = $1,400,000. Though such losses are still not materialized and have no impact on the cash balances, they have to be recognized and reported under the heading of Other Accumulated Comprehensive Income A/c shown under the major heading of Shareholder’s equity.

6) Are You Aware Of Minority and Majority Stake?

This question tests your knowledge of the core principles of merger and acquisitions.

Sample Answer

A minority stake simply means that the investment made in an organization is less than 50% and the majority stake is more than 50%. A majority stake in an organization, gives the acquirer company, controlling interests and rights in that company, which can be used to influence the business decisions. On the other hand, minority or passive investments, are made to enjoy capital appreciation and dividend incomes.

7) What Motivates You To Work?

There are several motivational factors for different individuals, that motivate them to work regularly and work harder in order to achieve their goals in life. These are specific to a person and depend upon its own conditions, circumstances, and situations. Just give a genuine response.

Sample Answer

Being an enthusiastic and hard-working person, my desire to get widespread recognition from my colleagues, relatives, and friends, pushes me to work hard and reap the benefits of higher incentives. Further, I also want to progress in my career and achieve those managerial positions, which have the ability to manage a large number of employees.

8) What Is Your Awareness Of Stock Repurchases?

This question tests your knowledge of the core principles of financial management.

Sample Answer

Stock repurchases or buyback of stocks commonly refers to an organization purchasing its own issued shares from the open market. The price at which an organization can buy back its stock is commonly decided using the Dutch Auction Model of pricing, in which the shareholders of the company are offered a price bracket to choose from. The buying back process starts from the lowest value offered in the price bracket and slowly moves towards the highest value. By purchasing its own stock, an organization tends to consolidate ownership and enhance its stock price.

9) What Are The Various Services Offered By Wells Fargo?

This question tests your level of awareness and grip on the company, you are appearing for.

Sample Answer

Wells Fargo is an established financial services brand with its existence dating back to almost a century. There are various services offered such as:

- Mortgage and Personal Loans

- Credit cards

- Investments in mutual funds

- Private and retail banking

- Loans to small business enterprises

- Fixed/Term deposits

- Lines of credit/Overdraft facility

- Letters of credit, etc.

10) Explain Long Lived Tangible and Intangible Assets.

This question tests your knowledge of the basic accounting concepts.

Sample Answer

It is common for business organizations to purchase fixed assets, which can be of two types, Tangible and Intangible. Tangible fixed assets have the capability of being touched, seen, and perceived, whereas Intangible Assets do not have any physical existence. However, both tangible as well as intangible assets, have the capacity of extending economic benefits to an organization that exceeds 12 months. Some common examples are:

| Long-Lived Tangible Assets | Long-Lived Intangible Assets |

| Land and building | Patents |

| Machinery | Copyrights |

| Furniture | Trademarks |

| Factory | Goodwill |

| I.T Equipment, etc. | List of customers, etc. |

11) What Do You Mean By Non Convertible Debentures?

This question tests your knowledge of the basic concepts of fund raising and meeting the financial capital needs of an organization.

Sample Answer

Nonconvertible debentures are a debt instrument issued by an organization in order to raise debt from the financial markets by tapping common investors. It is cheaper for business houses to raise funds from the public, as compared to banks. Hence, they issue debentures, having a fixed face value and a fixed coupon rate. The investors investing their money in debentures, earn regular interest income along with an expectation of capital appreciation.

12) How Will You Handle A Disgruntled Customer?

This question enables an interviewer to examine the approach you like to follow while practically dealing with customers.

Sample Answer

In any business, there are discontent customers. The likelihood of such dissatisfaction enhances even further in the financial services firm. If I ever encounter such a situation, I would first use my active listening skills in order to completely understand the problem of a customer. Post this, I would use my analytical and critical thinking skills in order to generate an appropriate response for the customer. There are high chances, that he or she would be satisfied with my response, but if issues still persist, I would refer the case to my senior.

13) What Do You Mean By DuPont Analysis?

This question tests your knowledge of the various procedures related to analysis and evaluation.

Sample Answer

Dupont analysis is a stretched or extended analysis of the Return on Equity (ROE) ratio of a company. It breaks the ROE into several components. There are two types of analysis, a Three-point analysis, wherein the ROE ratio is further divided into three points by multiplying and dividing it by Sales/Sales. and a five-part analysis, wherein the ROE ratio is divided into five parts, by multiplying and dividing the three-point ratio with Assets/Assets.

14) What Is The Future Impact Of Technology On Financial Services Firms?

This question tests your creativity levels and your ability to stretch your imagination.

Sample Answer

Technology has made quick inroads into our personal as well as professional life. Nowadays, almost 60% of the tasks, including some of the core tasks, are being executed using technology. Mobile applications, in particular, have had a deep impact on the financial services industry. In the future, I assume, there would be the existence of virtual branches, wherein a customer can visit using a VR camera and operate his or her account and perform other retail banking activities.

15) Explain The Relevance Of Cost Of Capital?

This question tests your knowledge of the basic concepts of fund raising.

Sample Answer

Capital is a raw material especially for the organizations engaged in the business of providing financial services. There are various methods for raising capital, such as:

- Issue of Equity shares

- Issue of Debentures

- Bank loans

- Overdraft against a mortgage

- Private Equity investment, etc.

Each capital alternate, has its own cost of funding, with equity financing being the most expensive source. The alternates chosen by an organization, are evaluated and a weighted average cost of capital is calculated. This calculation holds a lot of significance and relevance, as an organization is always advised to accept a business proposal or even continue its operations, only if, the return on equity exceeds the cost of capital.

16) What Do You Mean By Floating and Fixed Rate Of Interest?

This question tests your knowledge of the basic concepts of financial awareness.

Sample Answer

A floating rate of interest keeps on changing with respect to the market forces of demand and supply. On the other hand, a fixed rate remains constant throughout the tenure of the financial product. Both, loans as well savings, are offered on this basis.

17) Who Were The Founders Of Well Fargo?

This question tests your factual knowledge in relation to the organization.

Sample Answer

There were two founders of this prominent institution, which are:

- Henry Wells and

- William Fargo

We can observe that the surnames of both these founders are used in naming this esteemed organization.

18) Name The Current CEO Of Wells Fargo.

This question tests your factual knowledge in relation to the organization.

Sample Answer

Sir, the current CEO of the company is Charlie Scharf.

19) What Is Your Biggest Strength?

This is a common interview question, that evaluates the personality of an individual and his or her level of self-awareness. Such a question must be answered after conducting careful scrutiny of the self.

Sample Answer

In my humble opinion, my ability to make informed business decisions, even in the most disturbing and inconducive working environment, contributes towards my strength. I have a superior level of concentration and focus, which I can employ while executing my duties. This helps me to achieve all my targets in a time-bound manner.

20) Why You Chose Us?

This is a common interview question through which an interviewer wants to know your level of seriousness and commitment towards the organization.

Sample Answer

Being a prominent financial services organization, having a rich history of more than 92 years and more than 70 million loyal customers, joining such an esteemed business house is no less than dream come true. Further, the salary offered and incentives extended by the company are really lucrative and tempt me further to join such a successful organization.

21) Do You Have Any Questions For Us?

This is the last question in an interview session. It is a common habit of an interviewer to give an opportunity of asking a few questions to the candidate. The questions must be related to the interview itself, job description, organization and job profile, etc. Ignoring or giving an unsatisfactory response to this question would simply deem that you are not prepared for the interview process and are simply not that serious for the organization.

Sample Questions

- What are the work timings?

- What are the various benefits offered by the company to its employees?

- Is there a provision of an employee stock option plan?

- What are the various allowances extended by an organization to its employees?

- What are the company’s policies in relation to harassment and ragging at the workplace?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (for Wells Fargo interviews):