Everything in this world revolves around money and finance. One can not imagine leading a life with a barter system nowadays as was the case centuries ago. With money comes banks, which are too in existence for a long time. With the advent of technology and increased competition, the focus has now shifted on providing the utmost satisfaction to the customers of the organization, and in this instant case customers of the banks. They hire a specialized phone banker in order to provide seamless and smooth financial services to their hard-earned and reputable customers.

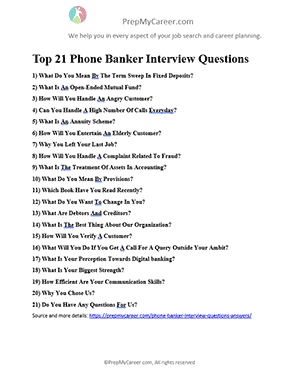

Best 21 Must-Read Interview Questions

1) What Do You Mean By The Term Sweep In Fixed Deposits?

This question tests your awareness of the various financial products launched by an organization.

Sample Answer

With an increase in global gross domestic products and disposable incomes of the people, there has been an abundance of financial products prompting individuals to save money for a better future. Sweep in Fixed deposits are one such financial instruments that allow an investor to transfer a pre-designated or pre-set amount from their savings account to a fixed deposit account which will enable them to enjoy higher returns. This amount can be transferred back to the savings account at no extra charges as and when there is a need for funds.

2) What Is An Open-Ended Mutual Fund?

This question tests your knowledge of the various financial products. As a phone banker, you will face constant queries about the various financial products offered by the institution you are working with.

Sample Answer

Sir, an open-ended mutual fund is a type of mutual fund with no maturity period or date. Once it is launched by an issuer, the units of mutual fund can be purchased at any time from the market at the price prevailing at that point in time. Similarly, these units can be redeemed in the market at any point in time. There is no provision of redemption of units by the issuer. At the time of purchase and sale, an investor has to pay entry and exit load receptively, which goes into the pocket of the issuer of the mutual fund scheme.

3) How Will You Handle An Angry Customer?

Banks deal with the general public and it is quite common for their customers to get disgruntled with any of the various services offered by it to its customers. Hence, you are expected to handle such a delicate situation in a proficient manner.

Sample Answer

It is a common situation faced by employees of almost the service-based organizations. I am up and ready for it. Initially, I would calm down the customer who would most probably be yelling and shouting its compliant. I would acknowledge the co-operation and would use my active listening skills to completely understand the problem of the customer. Post this, I would analyze, evaluate, and would offer a superior resolution to my customer. In most probable conditions, I will be able to satisfy one, but if still, one is discontent, I would refer the matter to my senior manager.

4) Can You Handle A High Number Of Calls Everyday?

This question tests your attitude towards working in stressful and hectic conditions coupled with long stretched working hours.

Sample Answer

Yes sir absolutely. I have the ability to handle around 100 calls every day. For this, I always keep my mind positive, maintain a conducive work environment and improve my listening skills. When you are able to understand a problem in an efficient manner, half of the problem gets solved there and then. This gives me the ability to work in an expeditious manner, maintaining my efficiency and effectiveness at the same time.

5) What Is An Annuity Scheme?

This question tests your knowledge about the various financial products available in the market.

Sample Answer

Annuity schemes are launched by various financial institutions and are a preferred mode of investment by elderly people. Under this scheme, an individual has to pay a fixed lump-sum amount against he or she will be entitled to receive fixed periodic annual payments till the death of the individual or his or her spouse. There are various options available in an annuity scheme and one can enter purchase such a scheme, after the age of 30 years. One might get the purchase price back, based on the option chosen by him or her at the time of purchase.

6) How Will You Entertain An Elderly Customer?

Elderly customers of the bank, prefer to use phone banking for most of their needs. It is expected by every bank and financial institution that they are dealt with patience and extra politeness.

Sample Answer

Elderly customers are the most important customers of the organization who are dependent upon banks for several services such as pension, cash withdrawal, fixed deposits, etc. The queries of such section of customers must be handled on priority and must be solved in a time bound manner with maximum efficiency. I would understand their problem completely, and if the need arises, I would send an employee to their place of residence from the nearest branch.

7) Why You Left Your Last Job?

This is a common interview question, that tests your mindset and attitude towards your employers and the workplace.

Sample Answer

My last job was with a prominent financial institution namely ABC Financial Services. It was an excellent institution with timely credit of salary and some lucrative benefits. The only issue was with their work culture, wherein no clear rules or frameworks were established as to who one must report and clear one’s doubts with. In the absence of such basic rules and working procedures, my work was marred by deficiencies, and I had to bear the brunt of someone else’s mistakes. This prompted me to leave that organization and join a professional organization like yours.

8) How Will You Handle A Complaint Related To Fraud?

In the banking industry, there are various frauds and siphoning off of funds that come into the light every now and then. Customers complain about the same with the phone bankers of the organization. Hence, you are expected to solve them with maximum efficiency.

Sample Answer

The advent of technology brings various benefits and ease into our lives. But it is dual-faced and at the same time, there has been a significant increase in online frauds and cybercrimes. If I ever handle such a situation, I would solve it on priority and would check all the details from the customer’s accounts. I would carefully analyze the disputed transaction and would note down the destination of the fund transfer promptly. Post this, If I find something fishy, I would alert the fraud management team and get them aware of such malafide transaction.

9) What Is The Treatment Of Assets In Accounting?

This question tests your core concepts of commerce and banking.

Sample Answer

Sir, assets are shown in the balance sheet of an organization after deducting depreciation from them, which is calculated on the basis of a suitable method followed by the organization. When assets are purchased they are debited and when assets are sold, they are credited.

10) What Do You Mean By Provisions?

This question tests your core concepts of commerce and banking.

Sample Answer

As per the accounting concept of prudence, accountants are required to provide for and recognize the expected losses compulsorily. For this purpose, provisions are created which are a charge to the profit and loss account. There are various provisions created by an organization, such as:

- Provision for bad and doubtful debts

- Provision for Income tax

- Provision for Gratuity and other retirement funds

- Provision for all the restructuring liabilities, etc.

11) Which Book Have You Read Recently?

This is a common interview question that tends to evaluate your personality, interests and choices. You are free to choose any book that you have read recently, except any book related to romance, love and adult comedy. Be confident about the book that you are choosing, and be ready to face any counter question related to climax, plot or story.

Sample Answer

Sir, I am a vivid reader and have recently read (____mention the name of your book_______). It is an inspiring book, that instills confidence in me and gives me the required daily motivation to work hard and achieve great things in life. It has left a positive impact only lifestyle and has made me more committed and loyal.

12) What Do You Want To Change In You?

It is a common question, and just another way to ask your major weakness. Just be honest while answering as any imaginary weakness can be easily caught by any veteran interviewer.

Sample Answer

Sir, I believe my ability to lose my cool in difficult situations is the only thing that I want to change in myself. I tend to panic in situations that are negative and beyond my control. I am plugging this loophole of mine by constantly practicing meditation for about 15 minutes a day, Further, I have also joined an online course in relation to it.

13) What Are Debtors And Creditors?

This question tests your core concepts of commerce and banking.

Sample Answer

Sir, debtors are the parties, from which an organization expects to receive a sum of money. They are categorized as assets. Whereas, the creditors are the parties to whom payments have to be made by an organization for the purchases made or services taken from them. These are categorized as liabilities.

14) What Is The Best Thing About Our Organization?

This question tests your knowledge about the organization’s work ethics, culture, latest investments and approach of the management.

Sample Answer

In my humble opinion, investments made in new and upgraded technologies are the best thing about your organization. Recently, the company has launched an online bank account opening platform after developing a state-of-the-art mobile application. Such advancements coupled with a highly impressive infrastructure motivate employees to work hard and at the same time enhances your ability to retain talents at competitive costs.

15) How Will You Verify A Customer?

Rising online frauds and impositions, have made it compulsory for phone baking officers to verify their clients using a set of personal questions.

Sample Answer

The verification process is of pivotal importance in the banking industry. I always lay priority on it and prefer to ask a few questions from my customers. such as:

- What is your registered mobile number?

- What is the name of your mother?

If the answers to these questions are satisfactory, I proceed with the query. Otherwise, I would stop there and then and refer the phone call to my senior, who has permission to access the account of a customer and ask for some more personal details in relation to the concerned customer.

16) What Will You Do If You Get A Call For A Query Outside Your Ambit?

Usually, sections are created and roles are divided for various employees working in a financial institution. Every set of employees tasked with a similar role are grouped together into a team handling a particular complaint, say related to credit cards issued by the company. Any complaint outside the ambit must be transferred to the concerned section.

Sample Answer

If I ever encounter such a situation I would listen to the complaint carefully and would identify the nature of the problem. Post that, I would transfer the call of the customer to the section of employees who is responsible to handle such complaints. This is done in order to resolve the customer query in a more professional and amicable way.

17) What Is Your Perception Towards Digital banking?

Nowadays, more and more organizations are becoming tech-savvy and adopting modern and digital technologies in order to acquire new customers as well as satisfy the existing customers by providing an excellent level of services. Hence answer this question positively.

Sample Answer

Moving with the pace of time is an art. One must be willing and ready to adopt new ways of working and executing one’s tasks, duties and responsibilities. Digital banking is the need of the hour as customers nowadays prefer to get basic financial services such as account opening, fixed deposit creation, fund transfer, etc. from the comfort of their home. Hence. I highly rate digital banking and consider it to be the key to success.

18) What Is Your Biggest Strength?

This is a common interview question that tests your self awareness ability. If possible, always answer this question, after making a written report of your strengths and weaknesses.

Sample Answer

In my humble opinion, my active listening skills are my biggest advantage. I have the ability to listen to someone patiently as well understanding their problem in an effective manner. Listening is an art and I am proud to possess such quality in me. I hope, this advantage of mine could be beneficial for your organization as well.

19) How Efficient Are Your Communication Skills?

The position requires an employee to provide financial services through a telephonic conversation with its customers and clients. This requires you to be an efficient, polite, and smooth speaker. Hence, always answer this question positively.

Sample Answer

The primary requirement in order to become a phone banking officer is some impressive and polite communication skills. I have an effective speech and have the ability to answer in a soft tone. I rate myself highly in this arena and want to assure you that I can provide effective resolutions to the customers of the bank through a telephonic conversation.

20) Why You Chose Us?

This question tests your seriousness and commitment towards the organization you wish to do a job at.

Sample Answer

Being a prominent financial institution with branches spread in over 23 countries, your brand name is almost synonymous with money or finance. The company boasts of a loyal customer base of 50,000 plus satisfied customers and is one of the leading organizations in the field of digital and phone banking. I am thoroughly impressed by the investments made by the organization in electronic or mobile-based banking. I want to be a part of this wonderful and successful organization, which I believe has the capability to groom my future in an orderly fashion.

21) Do You Have Any Questions For Us?

It is a usual habit of the customers of the organization to conclude an interview session with this question. Through this, they want you to ask a few questions in relation to the job profile, work timings, organization’s ethics, vision, or mission statements. Skipping this question can prove fatal to your chances of selection as that would simply imply that you are under-prepared and not serious about the job opening.

Sample Questions

- What are the work timings for this job profile?

- What is the work culture of the organization?

- What are the anti-harassment and anti-ragging policies of the organization?

- Is there a provision of snacks and beverages inside the workplace?

- What are the various employee benefits offered by the organization to its employees?

Download the list of questions in .PDF format, to practice with them later, or to use them on your interview template (if you want to crack Interview):

Conclusion

Banks are money and we all know the importance of it. There are various financial institutions operating in the nation, with some having even overseas operations. If you have relevant skills and interests in becoming a phone banking officer, then look no further and start applying to the vacancies with some prominent institutions. However, the interview process is tough and requires some serious preparation with a broad understanding of frequently asked interview questions. If you like our articles then don’t forget to share them with your family and friends. Also, do let us know through the comments section below, how much you like our articles.

Elara Bennett

Elara Bennett